Order block is a concept in trading that refers to a specific price area on a chart where significant buying or selling activity has occurred. It is characterised by a cluster of orders that have been executed, resulting in a temporary imbalance between supply and demand. Order blocks can be identified by analysing price action and volume data, and they often serve as important levels of support or resistance in the market.

Traders who employ this strategy aim to identify and trade off the key levels created by order blocks. In the following, we will cover all you need to know about order block and order block strategy.

What is an order block?

When there is a cluster of limit orders in one spot, it is called an order block. Order blocks can be identified by analysing price action, volume, and market structure.

Support order block: When many buy orders are executed at a particular price level, it creates a demand zone or support order block. This indicates that buyers were willing to step in and purchase the asset at that price, suggesting that it is a level where buying pressure is likely to re-emerge in the future.

Resistance order block: when many sell orders are executed at a specific price level, it creates a supply zone or resistance order block. This suggests that sellers were willing to sell the asset at that price, indicating a level where selling pressure may come into play again.

Order blocks are significant because they represent areas where market participants have shown a strong interest in buying or selling. These levels can act as magnets for the price, attracting it back to the order block in the future. Traders often use order block trading strategy to identify key support and resistance levels, which can help them make informed trading decisions.

What is the order block strategy?

The order block trading strategy is a technique traders use to capitalise on the information order blocks provide. Traders who employ this strategy aim to identify and trade off the key levels created by order blocks. When a market approaches an order block, traders look for signs of a potential reversal or continuation of the prevailing trend.

By analysing price action, volume, and other technical indicators, traders can make informed decisions about entering or exiting trades based on the behaviour of prices around order blocks. This strategy allows traders to take advantage of the market’s reaction to these significant price levels, increasing the probability of successful trades.

Types of order blocks

There are different types of order blocks that traders commonly encounter in the market.

Here are some key types:

| Types of order blocks | Characteristics |

| Standard order block | Signalled by the last bullish candle before a dramatic and unexpected drop |

| Primary Impulse order block | Occurs when there is a reversal in trend but no accompanying notable price change. |

| Wick-Based Order Block | It is formed when the wick (the outside edge of a candle) is more than half the size of the candle. |

| Pullback Order Blocks | Created when price action reverses direction after making a large initial advance. |

| Mid-Movement Pivot Order Block | It’s the formation of a candle of the opposite colour in the midst of a substantial upward or downward trend. |

| Breakout Order Blocks | Happen when prices go beyond key support or resistance levels and act as new levels of support or resistance. |

| Breaker block | The transformation of a rejected order block into a new supply or demand area on the chart. |

| Engulfed order block | Develop when the body of one candle completely engulfs the body of the one before it. |

| ICT order block | The focus of the ICT Order Block idea is on analysing the actions of institutional traders and the effects they have on the market. |

Let’s dive into the main type of order block:

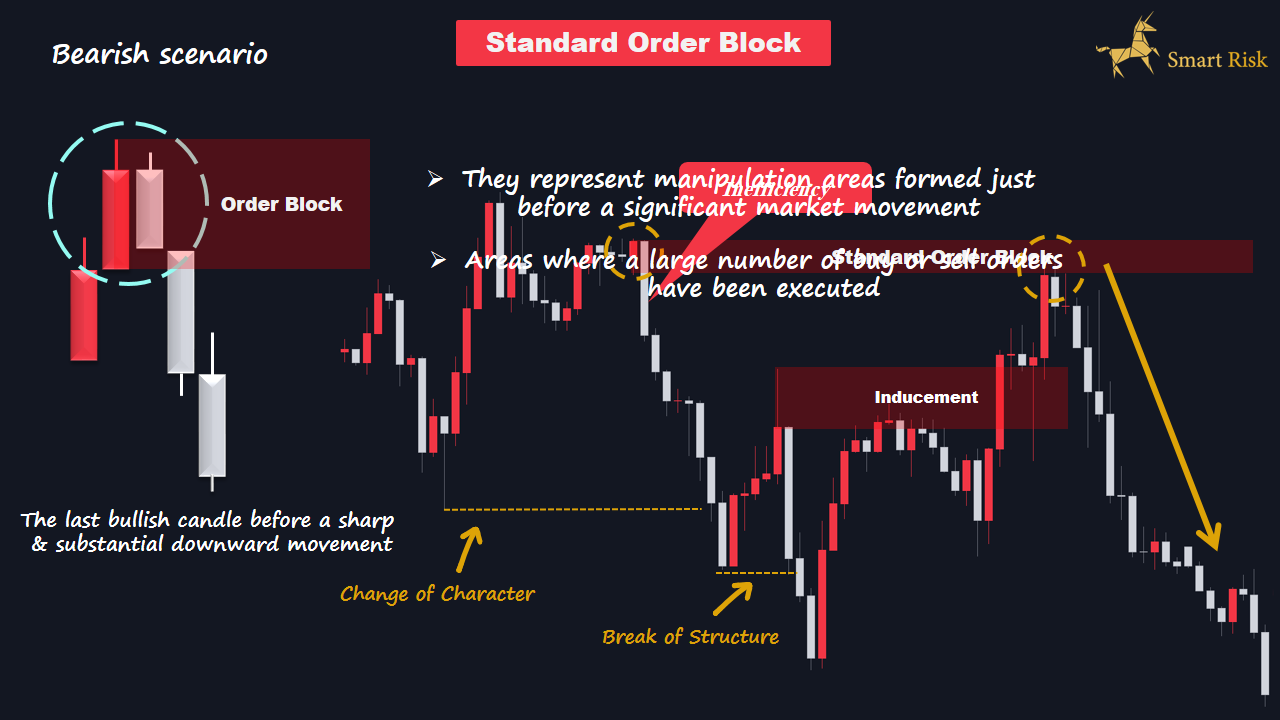

Standard order block

The Standard order block is the area indicated by the final bullish candle before a significant and sudden decline.

The idea that these zones might act as turning points rests on the assumption that they are regions of market manipulation that arise right before a major price shift. Traders consider these places to be concentrated centres of purchase and sell activity.

Since there is a good chance that the price will reverse and alter its direction when it hits these zones, we may use them as part of our trading plan to our benefit.

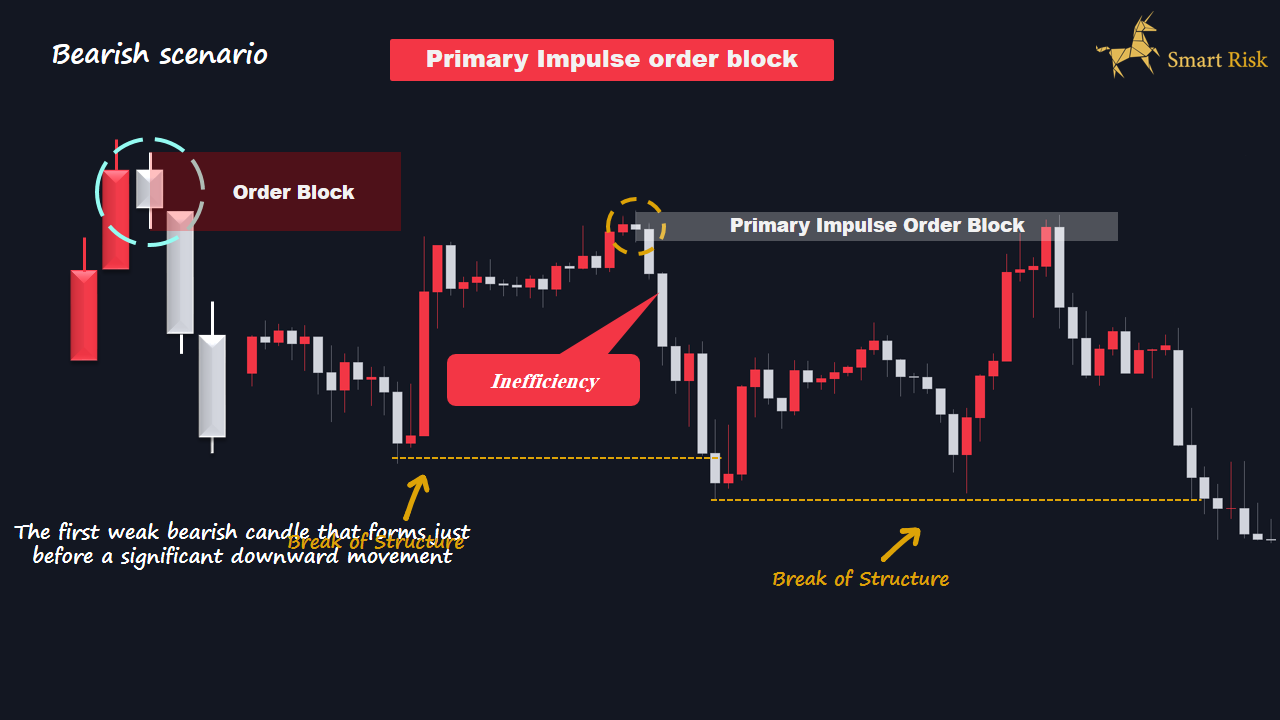

Primary Impulse order block

This kind of order block arises when the price reverses its major direction but fails to produce a strong or meaningful movement.

In a bearish situation, the Primary Impulse order block is the first little bearish candle that appears before a large drop. It marks a juncture at which the market showed insufficient enthusiasm to sustain its prior positive trend, which may portend a reversal or shift in market mood.

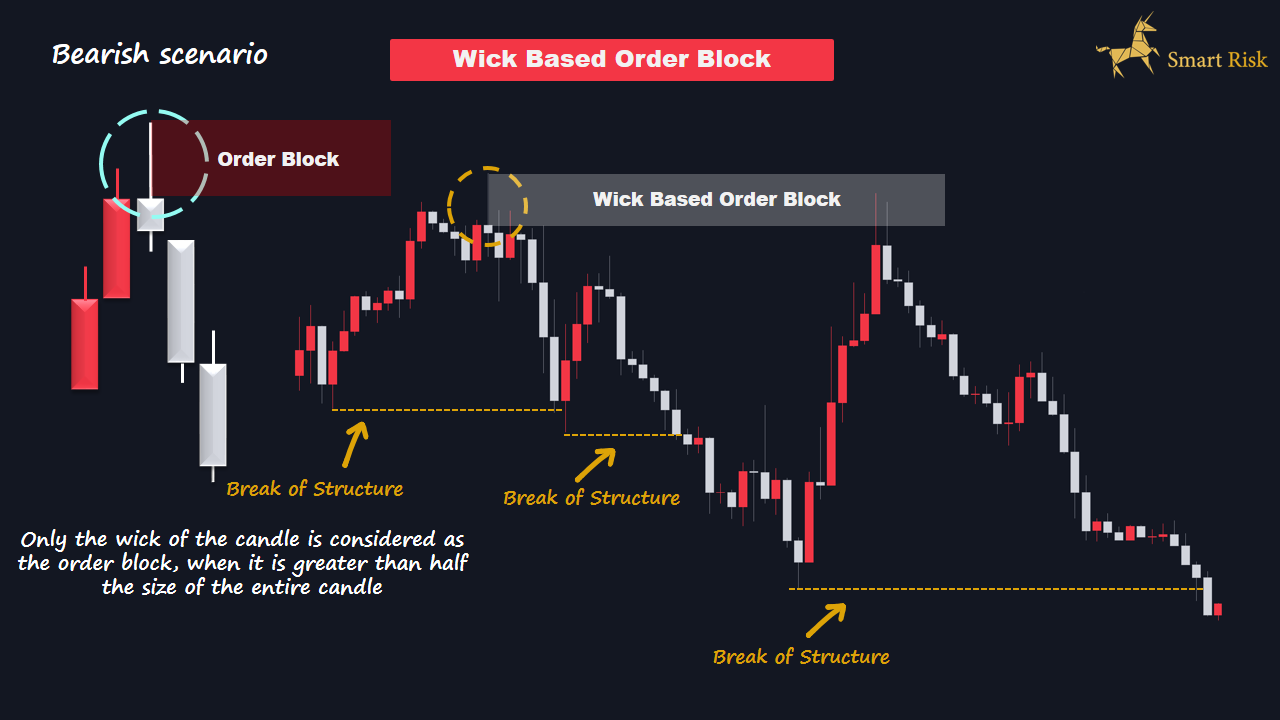

Wick-Based Order Block

When the wick (the outside edge of a candle) is more than half the size of the candle, it indicates a bearish pattern known as A Wick-Based Order Block. The candle’s wick alone is used as the building block here, with the candle’s body ignored. When opposed to focusing on the total candle size, this method yields a more focused and condensed region.

Breakout Order Blocks

Breakout order blocks occur when a price breaks through a significant level of support or resistance. These order blocks are formed due to the strong buying or selling pressure that leads to the breakout.

Breakout order blocks can act as new levels of support or resistance, depending on the direction of the breakout. Traders often look for breakouts from order blocks as potential trading opportunities.

Pullback Order Blocks

Pullback order blocks are formed when the price retraces or pulls back after a significant move in one direction. These order blocks represent areas where the price finds temporary support or resistance before continuing its previous trend. Traders often look for pullbacks to order blocks as potential entry points to join the prevailing trend.

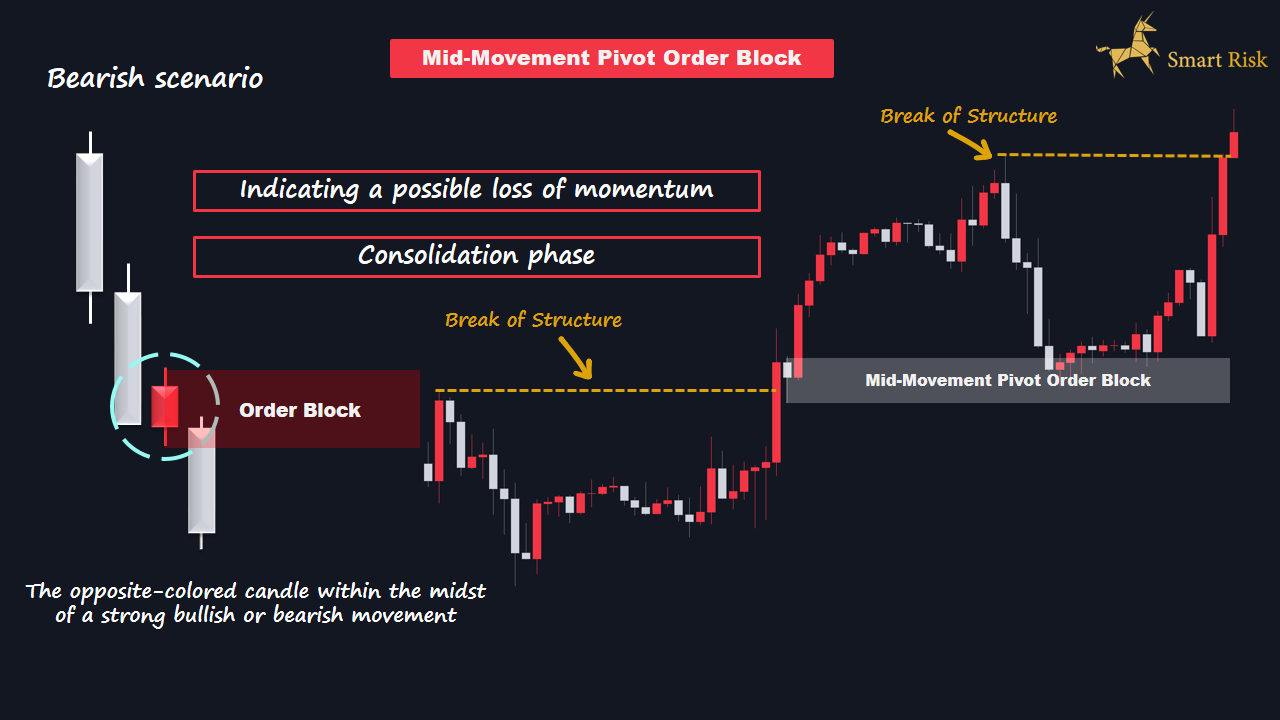

Mid-Movement Pivot Order Block

It happens when a candle of the opposite colour forms in the middle of a significant up or down trend. This candle may signify a trend reversal. Also, it’s a warning indicator that the market may be pausing or changing direction.

When the price reaches these regions, it often does a U-turn and moves in the other direction. They are useful indicators of a likely loss of momentum or consolidation period in the current trend and serve as vital signals. As a result, we keep an eye on these areas in the market since they might serve as pivot points for a reversal.

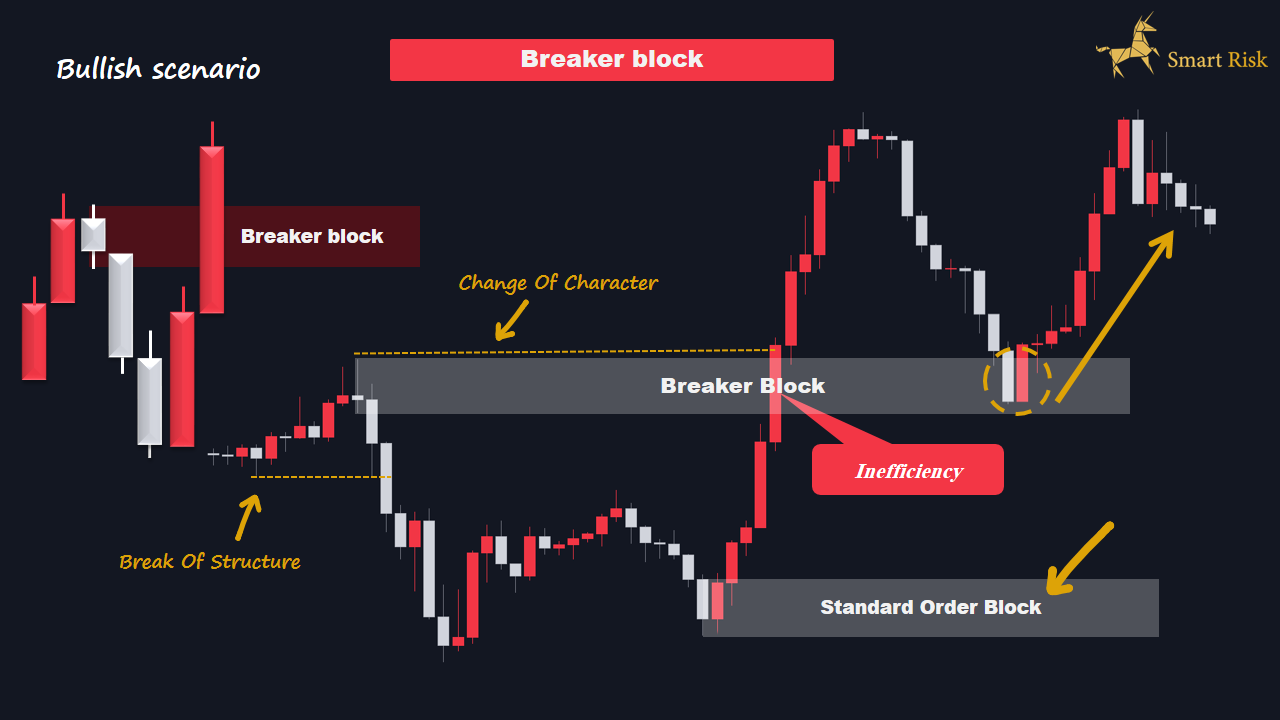

Breaker blocks

The term “breaker block” describes a failed order block that has been broken through and transformed into a new supply or demand region on the chart. Price breaks through a breaker block most effectively when there is a high-momentum candle with a little retreat.

There are several scenarios in which the market could care less about the supply and demand of order blocks. Some of them include a change in the market’s underlying structure, an overvaluation or oversell, accessing important levels on a greater time frame, and positioning the order block just below or above key liquidity zones.

We refer to a supply or demand level as a ” breaker block” if the price has passed through it after a valid order block trading strategy has failed to reject the price.

ICT order block

The ICT Order Block refers to a specific price area on a chart where institutional buying or selling activity has taken place, creating a significant level of support or resistance. The ICT Order Block concept emphasises understanding the behaviour of institutional traders and their impact on the market.

It focuses on identifying areas where institutional buying or selling has occurred, as these levels are considered significant. ICT Order Blocks are often called liquidity pools, representing areas where institutional traders have accumulated their positions. These blocks are formed when institutional traders execute large orders, consolidating orders and a temporary imbalance between supply and demand.

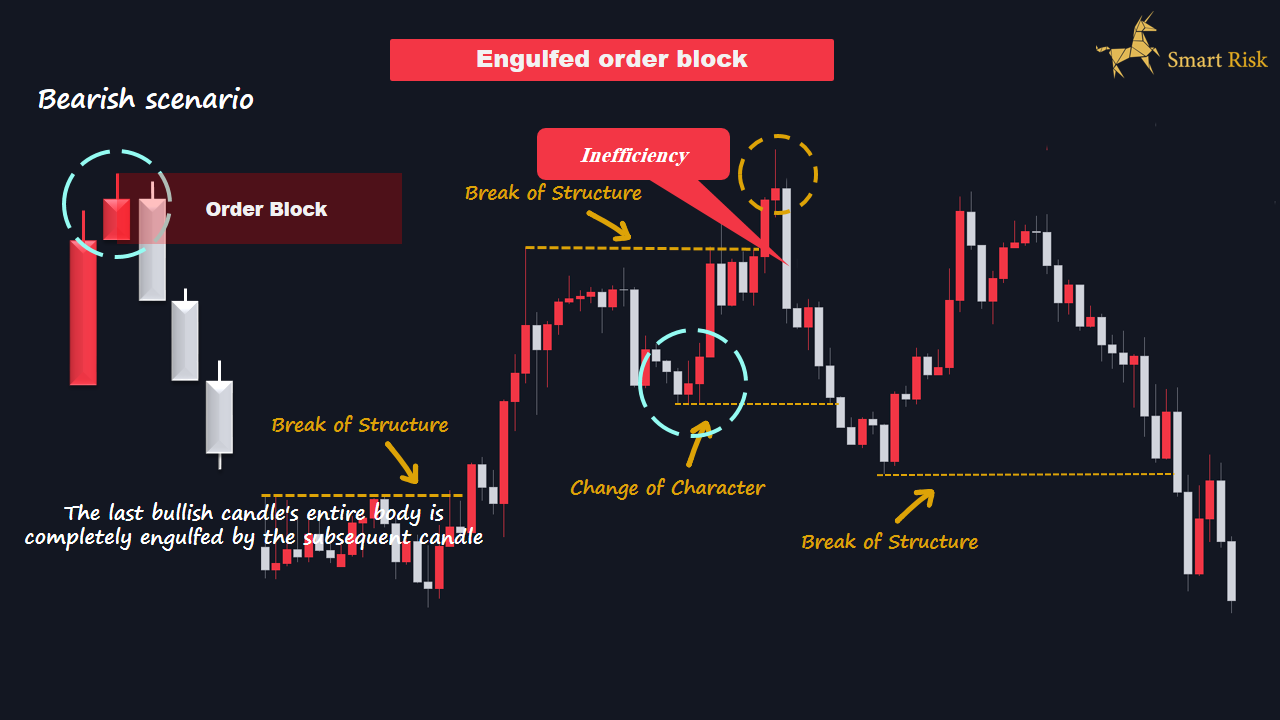

Engulfed order block

Bearish Engulfed Order Blocks form when the next candle entirely engulfs the previous candle’s body, signalling excessive selling pressure that counteracts the purchasing momentum and leads to a sharp and sustained decline.

It’s important to note that these types of order blocks are not mutually exclusive, and they can overlap or occur in combination. Traders analyse the characteristics and behaviour of these order blocks to make informed trading decisions and identify potential entry and exit points.

Attention: Check out our YouTube video, where we dive deep into the world of order block trading strategy and show you how to trade them effectively. Whether you’re a beginner or an experienced trader, our videos provide valuable insights, strategies, and techniques to help you make informed trading decisions.

Why do traders use order blocks?

Order blocks are important in trading for several reasons:

Market Sentiment

Order block trading strategy provides insights into market sentiment by revealing the buying or selling pressure at specific price levels. When a significant order block forms, it indicates a strong interest from market participants, reflecting their sentiment towards the asset.

Traders can gauge market sentiment by analysing the formation and behaviour of order blocks, helping them make informed trading decisions.

Indicates Liquidity

Order blocks represent areas of high liquidity in the market. These levels often attract many buyers or sellers, increasing trading volume and tighter bid-ask spreads. Traders can use the liquidity from order blocks to enter or exit positions with minimal slippage, ensuring efficient trade execution.

Price Rejection and Confirmation

Order blocks act as price rejection or confirmation levels. When the price approaches an order block, it may bounce off or reverse direction, indicating a rejection of that level. This price rejection can provide trading opportunities for traders looking to enter trades in the opposite direction.

Conversely, if the price breaks through an order block, it confirms the strength of the buying or selling pressure, suggesting a continuation of the price movement.

Price Consolidation

Order blocks often lead to price consolidation, where prices move sideways within a defined range.

Traders can identify these consolidation patterns around order blocks and use them to anticipate potential breakouts or breakdowns. Breakouts from order block consolidations can signal the start of a new trend, providing traders with opportunities to enter trades early.

Stop Loss Placement

Order blocks can be used as reference points for placing stop-loss orders. Traders often set their stop-loss levels just below or above an order block, as a break of the order block may indicate a shift in market dynamics. Stop-loss orders at order blocks help traders manage risk and protect their capital if the market moves against their positions.

Price Targets

Order block trading strategy can serve as price targets for traders. If the price breaks through an order block, it may continue to move toward the breakout, potentially reaching the next order block. Traders can use order blocks as reference points to set profit targets and plan their exit strategies.

Market Memory

Order blocks have a “market memory” effect, meaning that price tends to remember and react to these levels in the future. When the price approaches an order block, it often attracts buying or selling pressure as traders remember the previous activity at that level.

This can lead to price reversals, breakouts, or consolidations, providing trading opportunities for those who can correctly identify and interpret order blocks.

Key Support and Resistance Levels

Order blocks represent significant support and resistance levels on a price chart. These levels are formed when many buy or sell orders are executed, indicating strong interest from market participants.

Traders use order blocks to identify key levels where the price will likely react, bounce, or reverse. These levels can act as barriers influencing future price movement, making them important reference points for trading decisions.

How to trade order blocks? Step-by-step guide

Trading order blocks involve identifying key levels in the market where significant buying or selling activity has occurred. Here is a step-by-step guide on how to trade order blocks:

1- Identify order blocks

Start by analysing price charts to identify areas where significant buying or selling activity occurs. Strong price rejections or consolidations typically characterise these areas.

2- Determine the structure

Once you’ve identified an order block, analyse its price structure. To understand the order block’s context, look for clear swings and market structure.

3- Look for confluence

Seek additional confirmation by looking for confluence with other technical analysis tools or indicators. This can include trend lines, moving averages, Fibonacci levels, or other support and resistance levels. The more confluence you find, the stronger the potential trade setup.

4- Set entry criteria

Define your entry criteria based on the order block and confluence factors. This could involve waiting for a breakout above or below the order block, a pullback to the order block, or a specific candlestick pattern.

5- Set stop loss

Determine your stop loss level based on the invalidation point of your trade setup. This should be placed beyond the order block or the confluence level to protect your capital if the trade goes against you.

6- Set profit targets

Identify potential targets based on the distance between the entry point and the next significant support or resistance level. You can also use Fibonacci extensions or other technical analysis tools to set multiple profit targets.

7- Manage your risk

Calculate your position size based on your risk tolerance and the distance between your entry point and stop loss level. Ensure that your risk per trade is within your predetermined risk management guidelines.

8- Monitor the trade

Once you enter the trade, monitor it closely. Adjust your stop loss and profit targets based on price action and market conditions if necessary. Consider trailing your stop loss to lock in profits as the trade moves in your favour.

Remember, trading order blocks is just one trading approach, and combining it with other technical analysis tools and risk management strategies is important. Practice on a demo account or with small position sizes before implementing it in live trading.

What is the best timeframe to trade order block?

The best timeframe to trade order blocks can vary depending on your trading strategy, preferences, and the specific market you are trading. However, when trading order blocks, many traders succeed by focusing on higher timeframes, such as the daily or hourly charts.

Trading order blocks on higher timeframes can provide a more reliable and accurate representation of market structure and price action. It allows you to filter out noise and false signals in lower timeframes. Additionally, higher timeframes tend to attract more institutional traders, which can lead to stronger and more predictable market movements.

Some traders may prefer to use lower timeframes, such as the 4-hour or 1-hour charts, to trade order blocks. These timeframes can provide more frequent trading opportunities but may also be more prone to false signals and market noise.

Read More: Relative Strenght Index (RSI)+ RSI divergence

Most-advised tips to know before trading with Order block

Trading order blocks can be a useful tool for identifying potential areas of support and resistance in the market. Here are some tips to consider when trading order blocks:

Determine key levels

Once you identify an order block, determine the key levels within it. These levels can act as support or resistance; a break above or below them can signal a potential trend continuation or reversal.

Use proper risk management

Always set appropriate stop-loss orders to protect your capital. Consider the distance between your entry point and the nearest support or resistance level within the order block when determining your risk-reward ratio.

Practice patience

Order blocks may take time to develop and play out. Be patient and wait for clear confirmation signals before entering a trade. Avoid jumping into trades based solely on the presence of an order block.

Keep a trading journal

Maintain a trading journal to record your observations, strategies, and outcomes when trading order blocks. This will help you analyse your performance over time and adjust your trading approach.

Analyse volume

Pay attention to the volume during the formation of an order block. Higher volume indicates stronger market participation and increases the significance of the order block.

Confirm with other indicators

Combine order block analysis with other technical indicators such as trend lines, moving averages, or oscillators to strengthen your trading decisions. Multiple confirmations can increase the probability of a successful trade.

Continuously Learn and Adapt

The market is dynamic, and trading strategies must evolve. Continuously learn and adapt your approach to order block trading. Stay updated with market developments, refine your analysis techniques, and learn from successful and unsuccessful trades.

Rules for identifying high-quality order blocks

To find order blocks with a good chance of working, there are four rules we must adhere to. These rules are as follows:

- First Rule: The first rule is that a high-quality order block always leaves behind some considerable inefficiency. An inefficient market is one in which there is a shortage of buyers relative to the number of sellers. This appears like a void between the candles.

- Second Rule: The second rule is that a strong order block should cause the market to exhibit a shift in trend or character. A break of structure and shift in character are crucial signs that determine whether the market will continue in its original path or encounter a reversal.

- Third Rule: Pricing must sweep a liquidity area before reaching the order block. Traders may boost the order block’s validity and dependability as a possible turning point or region of interest by making the price sweep a liquidity zone before reaching the order block.

- Fourth Rule: It has to be undiluted. Since we only employ order blocks once, we focus on when the price enters the block. Once we have resolved an order block, we no longer see that market as potentially profitable. Simply put, an order block is no longer useful as a trading region after the inefficiency caused by it has been reduced, which happens when the price moves beyond the block’s bounds.

Conclusion

Order blocks are significant because they represent areas where market participants have shown a strong interest in buying or selling. These levels can act as magnets for the price, attracting it back to the order block in the future.

It’s important to note that order blocks are not foolproof indicators and should be used with other technical analysis tools and risk management strategies. Traders often combine order block analysis with other techniques, such as trend analysis, Fibonacci retracements, or moving averages, to increase the probability of successful trades.

FAQs

What is an order block?

An order block is a specific price area on a chart where significant buying or selling activity has occurred. It represents a consolidation of executed orders, indicating a temporary imbalance between supply and demand.

How can I identify an order block?

Order blocks can be identified by analysing price action, volume, and market structure. Look for sharp price movements followed by consolidation or sideways movement. High volume during the formation of the block can further validate its significance.

Why are order blocks important in trading?

Order blocks are important because they represent key levels of support and resistance. They provide insights into market sentiment, liquidity, and price movement. Traders use order blocks to make informed trading decisions, manage risk, and identify potential entry and exit points.

What is the order block trading strategy?

The order block strategy involves identifying and trading off the key levels created by order blocks. Traders analyse price action, volume, and other technical indicators to anticipate potential reversals or continuations at order blocks. This strategy capitalises on the market’s reaction to these significant price levels.

Are order blocks foolproof indicators?

No, order blocks are not foolproof indicators. They should be used with other technical analysis tools and risk management strategies. Considering the overall market context and using additional confirmation signals before making trading decisions based solely on order blocks is important.