Consider trading as a high-stakes game in which each move counts. Now, picture yourself with a well-thought-out strategy that would protect your money while increasing your chances of making a profit.

That is the fundamental core of a Money and Risk Management Plan. In a data-driven environment, when every market fluctuation has the potential to be a significant turning point, this strategy serves as your guiding principle.

Now, let’s explore the process of creating a strategy that effectively converts market data into strategic choices. This strategy is a guiding tool and a valuable asset in your trading endeavors.

What is Risk Management in Trading?

Risk management in trading involves employing strategies to safeguard capital and minimize potential losses. This is particularly crucial in dynamic financial markets where volatility can lead to rapid price changes.

For instance, a trader with a $50,000 capital might implement a risk management strategy limiting each trade to 2% of their capital, translating to a maximum risk of $1,000.

Additionally, employing stop-loss orders based on the Average True Range (ATR) could be used to adjust positions according to market volatility. If the ATR suggests a potential risk of $2 per share on a given trade, the trader might adjust their position size to ensure that the overall risk exposure aligns with their predetermined risk tolerance.

Risk management practices, grounded in real-time market data and statistics, empower traders to navigate the uncertainties of financial markets while preserving their capital and fostering sustainable trading strategies.

Read More: What Is SMC (Smart Money Concepts) In Forex Trading?

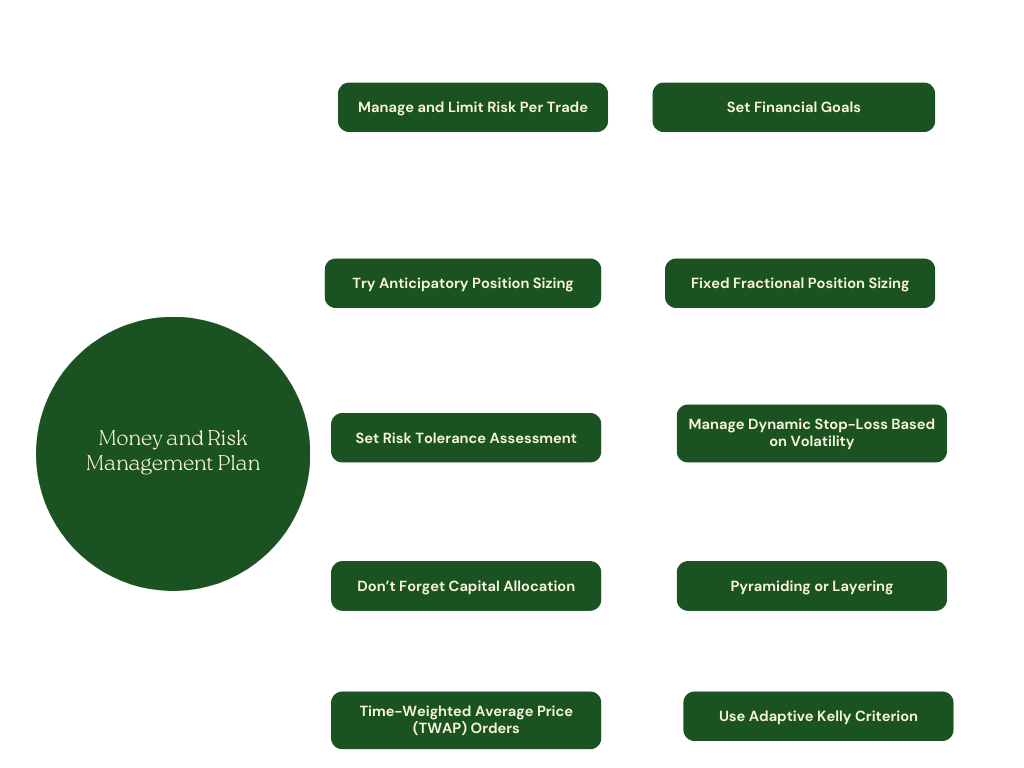

Money and Risk Management Plan

A solid Money and Risk Management Plan is vital for traders to navigate the markets prudently. Here’s an example of a comprehensive plan:

1- Set Financial Goals

Defining precise financial objectives is a crucial component of successful financial planning. Short-term and long-term objectives serve as a guide for investing strategies and risk mitigation.

A near-term goal may include accumulating funds for a holiday or a deposit on a residence during the next two years, while a distant-term objective could require financing a child’s education or preparing for retirement over 20 years.

It is crucial to determine the specific rate of return that aligns with each target, considering the related risk tolerance and timeframes.

Example: In the case of a short-term objective and a reduced tolerance for risk, a more cautious targeted rate of return may be around 5-7%. Conversely, a retirement objective that spans a lengthy period may suit those willing to take on more risk and anticipate an average annual return of 8-10%.

2- Manage and Limit Risk Per Trade

Limiting the risk per trade to a specific percentage of total trading capital is a fundamental aspect of risk management aimed at safeguarding against substantial losses that could jeopardize the overall trading portfolio.

Example: If a trader has a total capital of $50,000 and adheres to a 2% risk per trade, they would only expose $1,000 on any single trade. This means that even if the trade ends in a loss, the impact on the overall capital is controlled.

3- Fixed Fractional Position Sizing

The Fixed Fractional Position Sizing method is a risk management strategy where traders allocate a fixed percentage of their trading capital to each trade. This approach dynamically adjusts position sizes based on the current capital, preventing the risk of overexposure in any single trade.

Example: Suppose an investor starts with an initial capital of $75,000 and decides to implement a risk management strategy of 1.5% per trade. This approach means they are willing to risk $1,125 (1.5% of $75,000) on each trade.

If they identify a trade with a determined risk of $600 based on market analysis and volatility considerations, the investor will adjust the position size to adhere to the 1.5% risk limit. In this case, the investor would allocate funds to the trade in a way that limits the potential loss to $1,125, ensuring it stays within the specified risk tolerance.

4- Try Anticipatory Position Sizing

Anticipatory Position Sizing is a strategy that involves adjusting position sizes based on the anticipation of market volatility. By dynamically responding to perceived market conditions, traders aim to optimize risk exposure.

Example: In a low-volatility market, a trader may decide to increase their position size by 1.5 times. In this case, they can capitalize on potentially more predictable price movements. Conversely, during high-volatility periods, the trader may reduce position size by using 0.7 times to mitigate the increased risk associated with larger price swings.

This strategy aligns the trade size with the prevailing market environment, reflecting a proactive approach to risk management that considers the ever-changing nature of financial markets.

Time To Read: Best Candlestick Patterns in Trading

5- Manage Dynamic Stop-Loss Based on Volatility

Dynamic Stop-Loss Based on Volatility is a risk management strategy that involves adjusting stop-loss levels dynamically according to the current volatility of the asset. This approach recognizes that market conditions are fluid, and volatility can vary.

Example: If a stock’s average true range (ATR) is $2, a trader might set a dynamic stop-loss at 1.5 times the ATR, ensuring that the stop-loss distance is proportional to the prevailing volatility.

This technique allows traders to adapt their risk management to changing market dynamics, providing a more nuanced and responsive approach to protecting capital.

6- Set Risk Tolerance Assessment

Conducting a thorough risk tolerance assessment is critical in developing a successful trading strategy. This evaluation examines various factors, including financial situation, trading experience, and emotional resilience.

Those with a stable financial situation and a longer investment horizon might have a higher risk tolerance than someone with limited financial resources or a shorter time frame for their financial goals.

Example: If an individual has a $100,000 trading capital and determines, through assessment, that they can comfortably tolerate a 2% risk per trade, this translates to a maximum loss of $2,000 on any given trade.

7- Don’t Forget Capital Allocation

Capital allocation involves determining the specific amount of trading capital to allocate to each trade to avoid excessive risk exposure.

Example: If a trader has a total trading capital of $50,000 and decides on a 2% risk per trade, they would limit the capital allocated to any single trade to $1,000. This strategy ensures that even if the trade results in a loss, it remains within the predefined risk tolerance.

By avoiding allocating more than a small percentage, such as 1-2%, of the total trading capital on any single trade, traders can protect themselves from significant financial setbacks, maintain consistency in their risk management approach, and enhance the overall sustainability of their trading endeavors.

8- Pyramiding or Layering

Pyramiding or layering is a trading technique where positions in a trade are gradually increased or reduced as the market moves in the trader’s favor or against them. This strategy allows for scaling in or out of trades, providing flexibility and risk management at different price levels.

Example: A trader may open a position in a stock worth 25% of their target size and add incrementally as long as the transaction profits. In the event of a favorable movement in the stock, the trader can increase their position, maximizing prospective profits. On the other hand, if the deal goes against them, the progressive layering strategy allows the trader to minimize losses at several stages.

9- Use Adaptive Kelly Criterion

The Adaptive Kelly Criterion is a sophisticated risk management approach that uses the Kelly Criterion formula to determine the optimal size of each trade while incorporating adaptability in response to changing market conditions and historical performance.

The Formula: The Kelly Criterion formula, traditionally expressed as f* = (bp – q) / b:

-

- “F*” is the fraction of capital to allocate

-

- “B” is the odds received on the trade

-

- “P” is the probability of success

-

- “Q” is the probability of failure

Example: Suppose the calculated Kelly fraction suggests allocating 15% of trading capital to a particular trade. In that case, a trader might decide to be more conservative and use a fraction of 10% during periods of high market volatility.

10- Time-Weighted Average Price (TWAP) Orders

Time-weighted average Price (TWAP) orders are a strategic execution technique employed in trading to minimize the impact of larger orders on market prices.

If a trader uses a TWAP algorithm to execute this order, it means buying a fraction of the shares regularly throughout the day. This method aims to distribute the trading activity and mitigate the risk of significant price fluctuations if a large order were executed simultaneously.

Example: The approach involves breaking down a substantial order, such as buying 10,000 shares of a stock, into smaller portions and executing them evenly over a specified period, often a day.

11- Set Up Risk-Reward Ratio

Maintaining a favorable risk-reward ratio is a fundamental principle in effective risk management for traders. The aim is to ensure that the potential profits from trade outweigh the associated risks. With this strategy, traders might profit even if their market analysis is only right half the time, provided their successful trades result in larger profits than their losing ones.

Example: A common risk-reward ratio might be 1:2, meaning that the trader anticipates making two dollars in profit for every dollar at risk. When a trader sets a stop-loss order at $100, placing the matching take-profit level at $200 or higher is advisable.

12- Monte Carlo Simulation for Drawdowns

Monte Carlo Simulation for Drawdowns is a risk management tool that employs statistical modeling to assess the potential drawdowns in a trading strategy. By running numerous simulations, traders can gain a probabilistic view of the strategy’s risk profile and set realistic expectations.

Example: After conducting Monte Carlo simulations, a trader might find that a 20% drawdown occurs approximately 5% of the time within their trading strategy. This information is invaluable in preparing for and managing the inevitable fluctuations in performance.

Related Article: Your Roadmap to Famous Price Action Patterns

Components of a Risk Management Plan

Let’s see the most components and elements of a risk management plan:

-

- Identification: Identify potential risks, such as market volatility, economic events, or specific trade-related factors.

-

- Evaluation: Assess the probability and potential impact of each risk on the investment portfolio.

-

- Mitigation: Develop specific strategies for each identified risk, including setting stop-loss orders, diversifying the portfolio, or implementing hedging techniques.

-

- Adaptability and Continuous Monitoring: Risk management is a dynamic process. Monitoring market conditions and assessing risks are essential for adapting strategies to changing circumstances.

-

- Link between Risk Tolerance and Return Potential: Higher risk tolerance increases the potential for higher returns. However, striking a balance is essential to avoid excessive risk exposure.

-

- Informed Decision-Making: Integrating risk management into decision-making processes ensures that investment choices are made with a clear understanding of potential risks and the capacity to manage them.

Don’t Miss Reading: What Is Fair Value Gap (FVG)?

The Most Important Rules in a Risk Management Plan

A well-crafted Risk Management Plan is essential for navigating uncertainties in any project or business. Certain fundamental rules must be diligently followed to ensure its effectiveness, serving as the cornerstone for minimizing potential threats and maximizing opportunities. Here is The rules:

-

- Continuous Education: Keep abreast of evolving market conditions and risk management strategies through continuous education. Stay curious and open to learning.

-

- Anticipating “What-If” Scenarios: Contemplate various “what-if” scenarios to anticipate potential risks and devise mitigation strategies. This proactive approach enhances preparedness.

-

- Regular Stress Testing: Perform periodic stress tests on your investment portfolio to replicate difficult market situations. This approach helps in the identification of vulnerabilities and the refinement of risk management techniques.

-

- Behavioral Analysis: Understand your own behavioral biases and how they might impact decision-making during times of stress. Self-awareness is crucial for effective risk management.

-

- External Review: Periodically seek an external review of your risk management plan from a trusted financial advisor or peer. External perspectives can offer valuable insights.

-

- Tail Risk Protection: Consider incorporating strategies specifically designed to protect against tail risks—extreme and unexpected events that may disproportionately impact your portfolio.

-

- Dynamic Position Sizing: Implement a dynamic position sizing strategy that adjusts based on the perceived risk in the market. This flexibility allows for a more adaptive risk management approach.

-

- Redundancy: Introduce redundancy in critical aspects of your risk management plan. Having backup strategies or safeguards ensures resilience in the face of unexpected challenges.

-

- Peer Group Analysis: Compare your risk management practices with those of a peer group or successful investors. Analyzing alternative approaches can provide valuable insights for improvement.

-

- Tailoring Strategies: Adjust your risk management tactics to align with the distinct attributes of the assets you are trading or investing in. Various assets may need distinct risk strategies.

You May Also Want To Read: Mastering the MACD Indicator

Evaluating Trading Risks: Active Risk and Alpha, Passive Risk and Beta

Investors often analyze their portfolio’s active and passive components when evaluating trading risks.

Active risk, associated with alpha, represents the potential for outperforming the market, while passive risk, linked to beta, measures exposure to market movements. Here’s how to evaluate these components:

Active Risk and Alpha

This risk is associated with actively managed portfolios deviating from a benchmark index. It measures the volatility of returns that the portfolio’s beta cannot explain.

Alpha: Alpha represents the excess return generated by a portfolio beyond what would be expected based on its beta or market exposure. Positive alpha indicates outperformance, while negative alpha suggests underperformance.

Evaluation of Active Risk and Alpha

-

- Tracking Error: Assess the tracking error, measuring the active returns’ standard deviation. A higher tracking error implies higher active risk.

-

- Information Ratio: Calculate it by dividing the portfolio’s excess return (alpha) by its tracking error. A higher Information Ratio signifies better risk-adjusted performance.

Considerations of Active Risk

-

- Active Management Strategies: Understand the active strategies employed, such as stock picking or market-timing, to gauge their impact on active risk.

-

- Market Conditions: Assess the impact of market conditions on active risk. Certain strategies may perform differently in bull and bear markets.

Mitigation of Alpha

-

- Diversification: Diversify the portfolio to spread active risk across different assets and strategies.

-

- Continuous Monitoring: Regularly monitor portfolio performance and adjust strategies to manage active risk dynamically.

Passive Risk and Beta

This risk is associated with tracking a benchmark index in a passive investment strategy. It is influenced by the portfolio’s beta, representing its sensitivity to market movements.

Beta: Beta measures the systematic risk of a portfolio about the market. A beta of 1 indicates the portfolio moves in line with the market, while a beta greater than 1 suggests higher volatility and less than 1 indicates lower volatility.

Evaluation of Passive Risk and Beta

-

- Beta Calculation: Calculate the portfolio’s beta to assess its sensitivity to market fluctuations. A beta close to 1 implies market-like returns, while deviations indicate relative risk.

-

- Factor Exposure: Analyze factor exposures that contribute to beta, such as interest rate sensitivity or sector allocations.

Considerations of Passive Risk

-

- Benchmark Selection: Choose an appropriate benchmark for evaluation. The choice of benchmark influences the portfolio’s perceived risk and return characteristics.

-

- Market Conditions: Understand how changes in market conditions may impact beta. For example, economic shifts can affect interest rates and impact portfolios with high-interest rate sensitivity.

Mitigation of Beta

-

- Portfolio Rebalancing: Periodically rebalance the portfolio to maintain the desired beta exposure.

-

- Risk Factor Analysis: Regularly assess risk factors contributing to beta and adjust the portfolio accordingly.

Integrated Risk Assessment

Balancing Act: Striking the right balance between active and passive strategies is crucial. Consider the investor’s risk tolerance, investment objectives, and market conditions.

Dynamic Approach: Adopt a dynamic risk management approach. Market conditions change, and an effective strategy must adapt to these changes.

Professional Advice: Seek advice from financial professionals or analysts for a comprehensive evaluation. Their expertise can provide valuable insights into optimizing active and passive risk within a portfolio.

Time To Read: Liquidity Trading Strategy: Unveiling the Secrets

8 Risks of Neglecting Money Management in Trading

Not utilizing money management in trading can expose traders to risks and potential financial losses. Here are some dangers of neglecting money management in trading:

1- Risk of Significant Losses

Without proper money management, traders might risk a substantial portion of their capital on a single trade. For instance, a trader risking 10% of their capital on a single trade could face severe losses if it is unsuccessful.

2- Impact on Long-Term Performance

Consider a scenario where a trader consistently risks a high percentage of their capital on each trade. Even if they have a series of winning trades, a single substantial loss could significantly impact their overall performance. For instance, three consecutive losses of 20% each would result in a 49% loss of the trader’s initial capital.

3- Overtrading and Transaction Costs

Overtrading without proper money management can lead to increased transaction costs. For example, a trader executing multiple small trades without a clear strategy might incur higher fees and spreads, eroding potential profits.

4- Margin Calls and Forced Liquidation

Traders who use excessive leverage without effective risk management could face margin calls. For example, a trader with a leverage ratio of 10:1 might face a margin call if the market moves against them by just 10%. Failure to meet the margin requirements could lead to forced liquidation at a loss.

5- Inability to Recover from Drawdowns

Consider a trader who experiences a drawdown of 30% due to poor money management. They would need a subsequent gain of over 42% to recover from this loss just to break even. Without effective risk controls, the road to recovery becomes steeper.

6- Underestimating Market Volatility

Not adjusting position sizes based on market volatility can lead to unexpected losses. For example, during heightened volatility, a trade that typically risks 2% of the capital might lose 5% or more if volatility is not considered.

7- Psychological Impact and Decision-Making

Poor money management can lead to emotional stress, affecting decision-making. Consider a trader who, after a series of losses, decides to risk a larger percentage of their remaining capital to recover quickly. This emotional response often leads to further losses.

8- Risk of Capital Depletion

With proper money management, traders may avoid risking too much of their capital on a single trade. This approach can lead to significant losses, especially if the trade goes against them. Depleting capital reduces the ability to recover from losses and continue trading.

Last Words

Within the complex financial markets domain, the Money and Risk Management Plan is crucial for ensuring long-term prosperity. As we get to the end of our posy, it is clear that this strategy is a dynamic barrier against the risks inherent in trading, not just a list of rules.

It is the power that converts data into a strategic plan, safeguarding your investment during market instability and directing you toward your financial objectives.

We wish you a happy and successful trading experience!

FAQ

Most frequent questions and answers

You can only trade a safe amount of your equity based on your personal risk tolerance, trading plan, and current market circumstances. A rule of thumb of 1%-2% of each transaction is suggested to help traders efficiently handle drawdowns and keep their performance steady.

Assess your risk tolerance by considering your financial situation, trading experience, and emotional resilience. Be honest about how much risk you can handle without jeopardizing your trading capital.

Traders can only maintain profitable trading habits by first mastering the art of money management. Capital allocation, risk limits, and position sizing are all part of this. It protects investors’ money so they may continue trading over the long term, even if market conditions temporarily worsen.

Reviewing and updating your Money and Risk Management Plan regularly is advisable, especially when there are changes in market conditions, trading performance, or personal circumstances.