Overtrading is like attempting to fit a square peg into a round hole. It involves buying and selling too many financial assets out of fear, joy, or greed. Imagine that you’re not following your plan and are making trades all over the place in the hopes of making money quickly.

The catch is that it often does more harm than good. Overtrading can cost you money, raise risks, and cause you to lose money, whether you’re an individual seller or a company. Don’t worry, though.

You can avoid overtrading and set yourself up for trading success if you have a good trading plan, control your risk well, and keep an eye on your feelings. Mistakes that cost a lot of money.

What Is Overtrading?

Whether a company or an individual seller, overtrading is when they buy and sell stocks too much. Individual traders overtrade when they go beyond their set risk limits or make deals without thinking, which is known as careless trading.

- Example: A lone trader may overtrade after losing in a different situation. For instance, a broker who loses $1,000 over several trades may try to get it back by making more rash trades. So, let’s say they trade 50 times a month instead of 10 times a month to make money quickly. However, this extra action can cause more losses because people make decisions based on emotions instead of following a well-thought-out trade plan.

Overtrading for Brokers

Churning is the act of brokers buying and selling stocks too much to make the most commissions. This dishonest behavior, which might be against the law regarding stocks, often happens when trading companies give their brokers monthly fee goals to meet.

Because of this, traders feel like they need to meet these goals, which causes them to make trades in their clients’ accounts that aren’t necessary and raises the commission costs for investors. Also, brokers may trade too much to push newly released securities, putting their client’s best interests behind their desire to make commissions.

Overtrading for Individual Traders

Individual traders overtrade when they take on more risk than they should, either because they are greedy or want to recover their losses quickly.

For instance, traders may not stick to their trading plans and instead engage in “revenge trading” after losing money, which usually results in even more losses. Lack of control or knowledge about how markets work can also cause individual players to overtrade. Overtrading for individual traders means taking on too much risk, usually caused by feelings or a lack of control and leads to poor trading performance and financial losses.

Don’t Miss Reading: If you want to understand the language of financial markets, you need to understand the concepts of market behavior, which include uptrends, downtrends, and range markets.

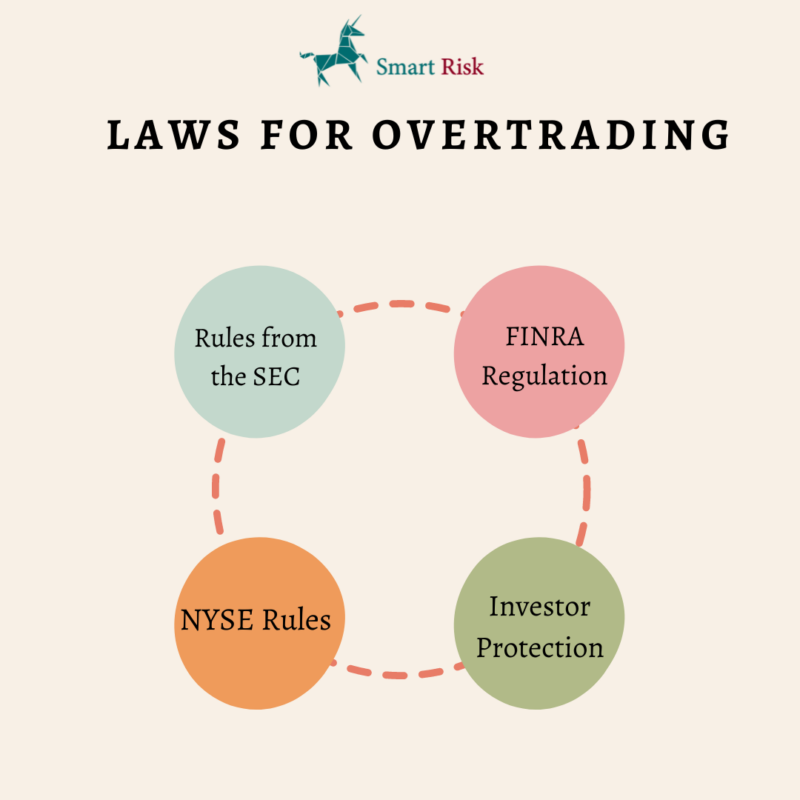

Are There any Laws for Overtrading?

There are several laws and rules in place to protect clients and keep the financial markets honest when it comes to overtrading:

1- Rules from the SEC

According to the Securities and Exchange Commission (SEC), overtrading, also called “churning,” occurs when a broker controls a customer’s account and buys and sells too much to earn more fees.

This action is against SEC Rule 15c1-7, which controls dishonest and misleading behavior in the stock market. Any brokers who trade too much might break this rule, leading to regulatory attention and possible fines.

2- FINRA Regulation

Rule 2111 of the Financial Industry Regulatory Authority (FINRA) governs overtrading. This rule says that traders must look out for their client’s best interests and not allow traders to trade too much, which could hurt investors. If FINRA finds that a broker has been overtrading, it can punish them by fines, license bans, or even termination.

3- NYSE Rules

The New York Stock Exchange (NYSE) also deals with overtrading because Rule 408(c) makes it illegal to do so in its territory. This rule clarifies that trading on the NYSE must be fair and honest and protects buyers from the negative effects of overtrading.

4- Investor Protection

If an investor thinks they have been a victim of churning or overtrading, they can file a report with either the SEC or FINRA. These governing groups look into these kinds of complaints and act against traders who have overtraded.

3 Most-Used Types of Overtrading

You can’t just follow one set of rules regarding overtrading. There are several kinds of overtrading, each with its effects and traits. Let us look at the different kinds of overtrading to see how they differ and might affect trading success.

Type 1: Discretionary Overtrading

When traders don’t have clear rules for account size and leverage, they make decisions that aren’t always the best. This is called discretionary overtrading.

- Example: Suppose a trader decides to buy 100 shares of Stock A without considering how much risk they are willing to take or how they want to allocate their assets. In the end, they might choose to buy 200 shares of Stock B without changing the size of their holding based on risk or market conditions. This lack of control and regularity in position size can lead to too much trading and higher risk exposure.

Type 2: Technical Overtrading

Traders engage in technical overtrading when they rely too heavily on technical indicators to support their trading choices without fully comprehending what these indicators mean.

- Example: A trader only looks at a moving average crossing indicator and decides to buy a stock because it shows a strong signal. They might not pay attention to other important things, like the basics of the market or trend research. Over time, relying too much on technical signs without doing enough research can cause confirmation bias when traders only look for information that backs up their already-established trade ideas. So, traders may keep losing money because their trades aren’t based on a full market study but on subjective readings of technical signs.

Type 3: Shotgun Overtrading

This is a careless way to trade, in which you buy many shares without a clear strategy or plan.

- Example: Think about a trader who opens many small positions in different stocks without doing much study or analysis first. They might buy stocks based on reports or tips from friends, social media, or speculators without looking at the facts or basic signs behind the companies. Traders who engage in shotgun overtrading may also find it hard to explain the reasoning behind their trades, which further highlights the lack of a clear trading strategy.

Time To Read: A liquidity trading strategy involves buying or selling an asset without causing significant price fluctuations.

How to Stop Overtrading?

Investors can help keep themselves from trading too much by doing the following:

1- Make a Good Plan for Trading

For focused trading, it’s important to make a detailed trade plan.

- Set clear short- and long-term goals as a first step.

- Think about the places you want to trade in, the trading style you like, the amount of risk you’re willing to take, and the timeframes you want to use.

- Make a plan for choosing trades, deciding when to enter and leave the market, and implementing risk management techniques.

- Your trade plan should be clear and specific. This will help you stay focused and follow the rules, especially when the market changes.

2- Use Risk Management Techniques

Trading successfully depends on being able to handle risks well.

- Figure out how much you’re willing to lose on each deal. This is also known as the risk per trade percentage.

- Put stop-loss orders on every trade to protect your Cash and limit the money you could lose.

- Consider using position size strategies like the Kelly criteria or the fixed fractional approach to maintain consistency in risk exposure across trades.

3- Avoid Fear of Missing Out (FOMO)

Fear of missing out (FOMO) can make people trade in the rush of the moment and trade too much.

- If you feel you might get FOMO, avoid financial news outlets, social media, and trade newswires.

- Taking breaks from market links can help you regain control and stop you from making hasty decisions because of fear of missing out (FOMO).

4- Work Out on Self-Awareness and give Yourself Breaks

Review your trade behavior regularly for trends that could mean you’re overtrading. If the number of deals each month keeps going up, there may be a problem. Self-awareness lets you fix problems and stop trading too much before it hurts your trade performance.

Moreover, feeling rushed to make a trade can lead to overtrading. When you stop investing for a while, you can review your methods again and make sure they still help you reach your overall business goals. It also lets you get your mind back on track and stop making hasty decisions.

5- See Cash as a Position

Don’t see Cash as a missed chance to make money; instead, see it as a defense position. Know that having Cash on hand keeps you from selling too much and losing money.

Accept Cash as a valuable tool that can buy you time and help you wait for the best buying chances. As your last defense against selling too much, it helps you keep your money safe over time.

Learn More About Forex: Money and risk management in trading involves employing strategies to safeguard capital and minimize potential losses.

What Is the Difference Between Overtrading and Undertrading?

Undertrading is when people don’t trade at all, even though there are chances. This can be because they fear losing money, don’t have an organized trading plan, or are being too careful.

Traders may keep their money in the bank for a long time, keep small amounts, or set strict entry conditions, meaning they miss out on chances to make money and grow their businesses.

This careful attitude might make it harder to achieve the possible benefits and cause resources to be used inefficiently.

| Aspect | Under trading | Overtrading |

| Trading Activity | Minimal or no trading activity despite opportunities | Excessive trading activity beyond the trading plan |

| Cause | Fear of losses, lack of confidence, overly cautious | Impulsiveness, emotional decision-making, desire for quick profits |

| Risk | Missed opportunities for profit, reduced growth potential | Increased transaction costs, higher risks, potential losses |

| Trading Plan | Lack of structured trading plan | Deviation from or absence of a trading plan |

| Effect on Returns | Potential for lower returns due to missed opportunities | Potential for lower returns due to increased risk exposure |

| Impact on Resources | Inefficient resource utilization | Potential depletion of trading capital |

| Investor Behavior | Conservative approach, reluctance to take risks | Aggressive approach, excessive risk-taking |

Last Words

Traders may stray from their trading plans and make too many trades when feeling fear, joy, or greed. This usually leads to more dangers, higher trade costs, and money losses.

Problems can arise when traders go beyond their risk limits or when they churn to make more fees. To avoid trading too much, it’s important to have a clear trade plan, handle your risks systematically, and watch out for your emotions.

FAQ

Most frequent questions and answers

Overtrading can happen in many markets and industries, but it happens most often to traders who are new to the game or don’t follow a focused plan. Traders may start overtrading because they make decisions based on emotions, don’t know how to handle risk, or want to make money quickly.

Overtrading can greatly affect traders, such as higher transaction costs, risk, and even financial losses. Trading choices based on emotions can cause rash actions against a well-thought-out trading plan, leading to less-than-ideal trading outcomes.

Traders should use good risk management methods, stick to a clear trading plan, and keep their emotions in check if they don’t want to overtrade. Additionally, traders should always consider how they trade, keep up with the market, and avoid making hasty choices based on fear or greed.