A good trader needs to know a lot of different ways to trade stocks. Swing trading is one of the more common methods.

This approach aims to ride a stock price trend, whether going up or down. The best stocks to swing trade are profitable in the short and long run. This makes swing trading a good strategy for traders who want to make money quickly with the most upside.

Fundamental analysis is a tool that many swing traders use to look at stock market trends. It’s hard to find the best swing trading techniques, whether you use technical tools to figure out chart patterns or time your trades around when earnings reports come out.

What Is Swing Trading?

Swing trading is a flexible way for traders to profit from short—to medium-term changes in market prices. Although day traders close their positions during the same trading day, swing traders usually keep their positions open for days or weeks to profit from expected price changes.

These methods involve carefully studying technical data, chart patterns, and market trends to find the best times to enter and exit the market. Some traders focus on risky assets to make bigger gains, while others prefer less volatile stocks to make their moves more predictable.

Regardless of the commodity, swing trading success depends on careful planning, managing risk, and timing the market well to profit from price changes within a set time.

Time To Read: A liquidity trading strategy involves buying or selling an asset without causing significant price fluctuations.

Advantages and Disadvantages of Swing Trading

Here are some good and bad things about swing trading:

| Advantages | Disadvantages |

| Time Efficiency: Suitable for part-time traders. | Market Risk Overnight and Weekends: Exposure to risks from news and events. |

| Maximized Profit Potential: Captures short-term price moves. | Potential for Sudden Reversals: Risk of significant losses from unexpected market changes. |

| Focus on Technical Analysis: Relies on charts and trends for easier trading. | Missed Long-Term Trends: May miss out on long-term gains. |

| Flexibility: Adaptable to various market conditions and asset types. | More Emotional Stress: Increased pressure from monitoring short-term price changes. |

| Effective Risk Management: Use of clear entry, stop-loss, and take-profit levels. | Relying on Technical Analysis: May overlook important underlying factors affecting market behavior. |

Advantages of Swing Trading

- Time Efficiency: Swing trading takes less time than day trading, so it’s good for busy people or traders who only do it part-time.

- Maximized Profit Potential: Swing traders try to make the most short-term money from price changes by collecting most of the market’s moves.

- Focus on Technical Analysis: Swing traders should examine chart patterns, symbols, and market trends when using technical analysis to make Trading easier.

- Flexibility: By adapting swing trading to different market situations and asset types, traders can take advantage of short-term opportunities in several markets.

- Effective Risk Management: Swing traders often use clear entry, stop-loss, and take-profit levels, which helps them control risk and make smart trade choices.

Disadvantages of Swing Trading

- Market Risk Overnight and on the Weekend: Swing trade situations are open to market risks overnight and weekend, such as possible price gaps caused by news or events in other countries.

- Potential for Sudden Reversals: Swing traders can lose much money if the market changes quickly or something unexpected happens, especially if their stop-loss orders are unplanned.

- Missed Long-Term Trends: Because swing traders are focused on the short term, they might miss longer-term market trends and chances. This means they might miss out on bigger gains they could have made by keeping contracts longer.

- More Emotional Stress: Swing traders may feel more emotional stress and pressure to make quick decisions when monitoring short-term price changes and managing their positions over short periods.

- Relying on Technical Analysis: Technical analysis can help with short-term investing. However, if you only use technical signs, you might miss important underlying factors that could change how the market acts and how much an object is worth.

Time To Read: Harmonic patterns in Trading have become indispensable tools for traders seeking to navigate the complexities of financial markets. These patterns, rooted in the principles of technical analysis and Fibonacci ratios, offer a unique perspective on potential trend reversals.

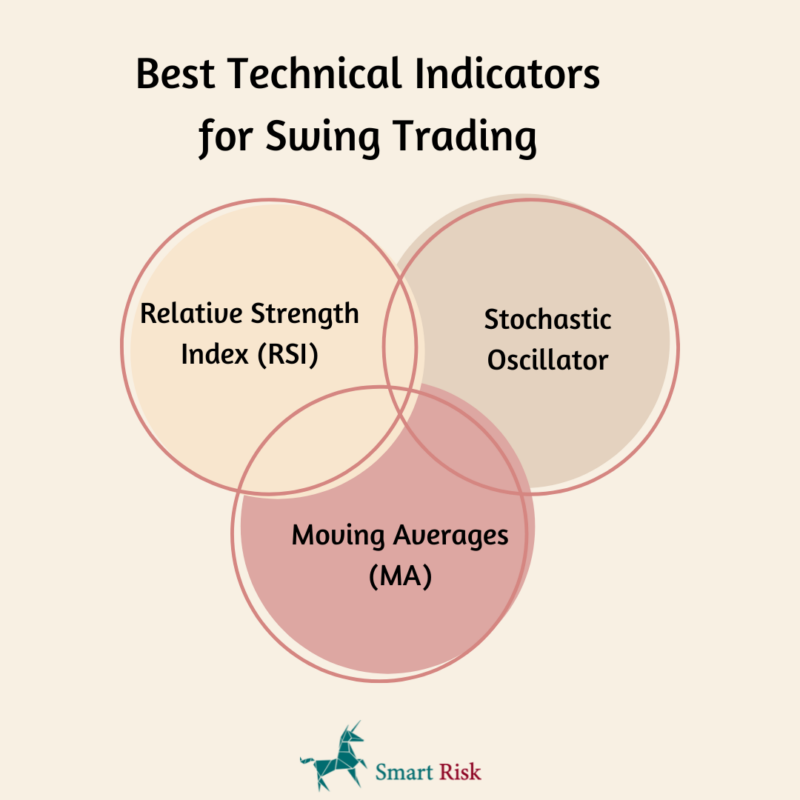

What Are the Best Technical Indicators for Swing Trading?

Swing traders often use analytical indicators to help them decide what to do with their trades. These signs look at past price trends and how the market is acting now to find good times to enter and leave the market. A lot of people who trade swings use these three basic indicators:

1- Relative Strength Index (RSI)

It checks for possible overbought or oversold situations and measures the strength of a trend’s progress. A value above 70 means the market is overbought, and a value below 30 means the market is oversold. Swing traders use RSI to assess the likelihood of market declines and changes in direction.

2- Moving Averages (MA)

Moving averages (MA) show the average price at which an object closed daily over a certain time, like 30 or 50 days. They make trends easier to see and prove their direction.

Many swing traders use crossings between moving averages, like the 50-day and 100-day moving averages, to see when prices will change direction. If the 50-day MA crosses above the 100-day MA, this could mean that the trend is going up. On the other hand, if the 50-day MA crosses below the 100-day MA, this could mean that the trend is going down.

3- Stochastic Oscillator

The stochastic oscillator looks at the final price of the trading range over a certain amount of time, usually 14 days, to determine how fast prices are moving. It helps determine when the market might change direction before traffic peaks.

The oscillator ranges from 0 to 100, with values above 80 indicating overbought conditions and below 20 indicating oversold conditions.

What Is the Right Market for Swing Trading?

Long-term trends in the stock market usually fall into one of three groups: the bear market, the bull market, or something in between. The way a swing trader works changes depending on the situation.

1- Trading in a Bear Market

Swing buying in a bear market is one of the hardest natural buy-and-sell trades. When there is a decline, prices on the stock market go down over time. So, buying a security with the hope that its price will increase over time is not a good idea. There are several ways to get around this:

- Cut the Time You Trade: You will see a faster turnaround on the stocks you keep instead of hanging on to them for weeks.

- Hold on to More Cash: Plan to keep some of the money you would normally trade in case the prices of the securities you own drop significantly.

- Change From Stocks to Options (By Buying Puts): If you think prices are going down, it’s better to sell an investment first and then buy it back later than to buy it now and sell it later.

2- Swing Trading in a Bull Market

In contrast to bear markets, buying may be easier during bull markets. Prices tend to go up when the market is doing well, so it’s easier to buy a security and make money soon after. When swing trading during rising markets, there are a few things you should remember:

- The Points of Entry Are Higher: If broad markets have increased in value since you sold your holding and took your winnings, general market stocks will likely become more expensive, and the prices of securities will likely increase.

- Bad Habits: People who trade often develop bad habits during bull markets. Keep studying the market and the best securities to hold. It may seem like every security is a winner, but that won’t always be the case.

- Consider Using Leverage: Consider how much danger you are willing to take before using leverage. But if you think the markets will keep going up, you might be able to increase your stock by using leverage.

3- In-Between Market Conditions

When the markets move sideways, investing in swing trades is best. The best times for swing trading are usually when the market is changing from a bear market to a bull market or when there is a lot of confusion. There are many things to think about:

- There Should Be Volatility: You have the best chance of making trades when markets move both ways. When volatility only goes in one direction, like during a bull or bear market, it can be harder to make trades.

- Safest Conditions: As you might expect, not all swing trades work out. Stable market conditions will likely keep your losses minimum if you have to hold on to assets. Prices tend to rise again after a brief drop, so investors don’t have to hold on to shares when the market is strongly falling.

Suggest To Read: The MACD indicator is widely used in stocks, forex, and cryptocurrencies. It helps traders identify crucial market trends, including divergences, crossovers, and overbought/oversold conditions.

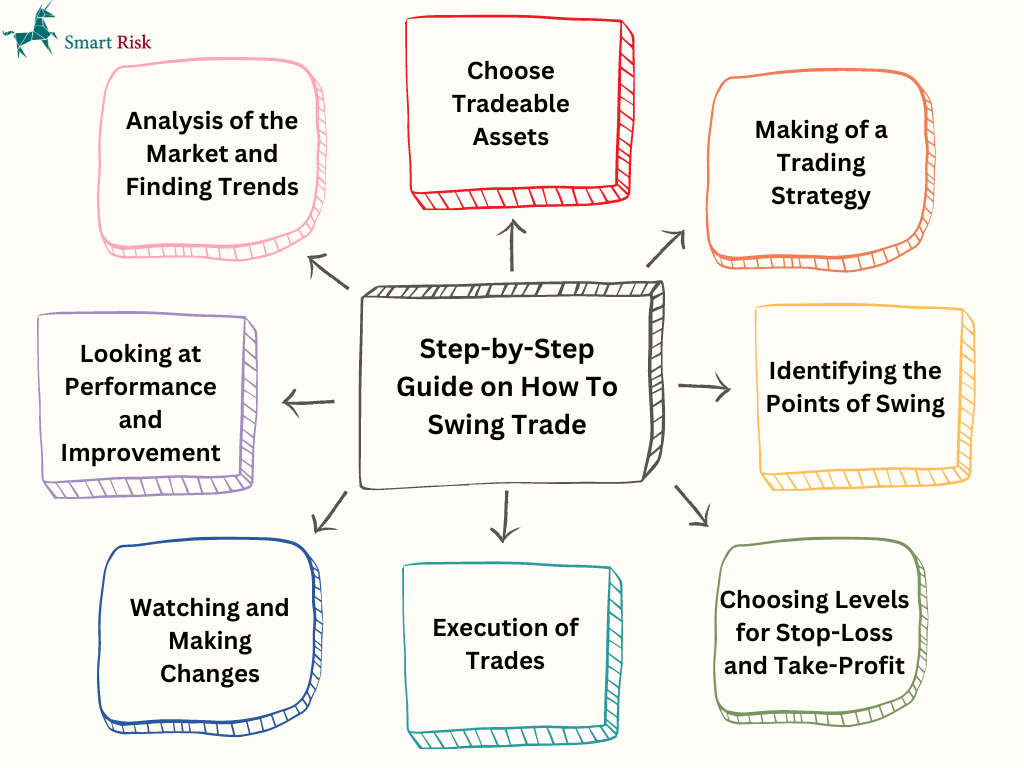

Step-by-Step Guide on How To Swing Trade

Here’s a detailed step-by-step breakdown of how swing trading works:

Step 1: Analysis of the Market and Finding Trends

First, look at how the market is moving. Imagine that you are a detective looking for signs. Check price data to see if the market is going up, down, or only going sideways. For example, if you look at a stock chart and see that the highs and lows stay higher over time, the stock is probably in an upswing.

Step 2: Choose Tradeable Assets

Once you know the trend, it’s time to pick your investments. Picture yourself as a cook choosing the best food. Choose liquid and volatile investments, such as stocks, forex pairs, or commodities. For instance, if you notice that the price of a certain currency pair has been changing a lot lately, it might be a good choice for swing trading.

Step 3: Making of a Trading Strategy

Let’s make a plan for your trade now. Put yourself in the shoes of a planner making a plan. Set rules for managing risk and deciding when to enter and leave a trade. You can also use moving averages or MACD to help you make choices. You could, for example, decide to buy when the price goes above a certain moving average and sell when it goes below another.

Step 4: Identifying the Points of Swing

Now is the time to find those swing points! When the market grows, look for opportunities to buy near-fall lows or support levels. In decline, however, look for opportunities to sell short near swing highs or support levels. If you see a company going up and down several times after hitting a support level, it might be a good time to go long.

Step 5: Choosing Levels for Stop-Loss and Take-Profit

You can use stop-loss orders and take-profit orders to limit losses if the trade goes against you. Take-profit orders will lock in profits at certain levels. One example is setting a stop-loss at a certain percentage below your starting price and a take-profit at a certain percentage above it.

Step 6: Execution of Trades

It’s time to carry out your plan! Use an online tool to make trades and enter positions based on your plan and conditions. For instance, if your strategy says to buy when a certain technical indicator shows a positive sign, place your trade as planned.

Step 7: Watching and Making Changes

Be alert, like a guard watching over a castle. Monitor prices closely and adjust your stop-loss or take-profit levels as needed. You could even use tail-stop-loss strategies to protect your income while leaving room for wins. If the price goes in your favor, you could move your stop-loss to follow it, protecting your gains.

Step 8: Looking at Performance and Improvement

After the trade is over, think about how well you did. Look at the result, figure out what went well and what could have been done better, and then change your plan to fit. Change your stop-loss levels to give your trades more room to breathe if you keep getting stopped too early.

Suggest To Read: Fibonacci retracement levels are horizontal lines on a price chart used in technical analysis to identify potential support or resistance levels in a financial market. These levels are based on key mathematical ratios derived from the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones.

Top 5 Swing Trading Strategies

Here are five effective swing trading strategies that traders commonly utilize to identify profitable opportunities and manage risk:

1- Fibonacci Retracements

In the confusing stock market world, Fibonacci retracements help you navigate. They assist you in identifying probable support and resistance levels by assuming that markets retrace a predictable percentage of a move before resuming the original direction.

You can use Fibonacci retracements by finding the swing high and swing low points of a stock’s price action and drawing lines at the key Fibonacci levels to find possible entry and exit points. Yet, like any other tool, they’re imperfect, and trade signs should be checked against other basic analysis tools and markers.

2- Support and Resistance

The backbone of basic swing trading analysis is support and resistance. They show the price levels where a stock usually changes its mind. Support levels are like a floor that the stock price finds it hard to fall below. On the other hand, resistance levels are like a roof that the stock price finds hard to break through.

Traders use these numbers to decide when to enter and leave a trade, where to put their stop-loss orders, and how strong a trend is. When prices break above or below support, it can signify a new trend and a chance to trade on the move.

2- Bollinger Bands

Bollinger Bands shows how volatile the stock market is by providing movable limits within it. A simple moving average is in the middle of these bands, and two lines show the standard deviations above and below it.

As the amount of activity in the stock price changes, these bands change, too. When volatility goes up, it gets wider; when it goes down, it gets narrower. Trend followers use Bollinger Bands to guess how the market might move by feeling the “squeeze.” This happens when the bands get very close together, which usually means the stock price is about to change significantly.

3- The MACD Crossover

Moving Average Convergence Divergence, or MACD, is like a guide for the stock market. People who trade in swings use this trend-following momentum measure to spot possible changes in the trend. Two lines make up the MACD.

The signal line is an average of the MACD line and comprises two exponential moving averages. The MACD line passes above the signal line, a positive sign that a rise may be started. A negative MACD crossing, on the other hand, happens when the MACD line falls below the signal line. This suggests that a decline may be starting.

4- Keltner Channels

Like railroad tracks, Keltner Channels act as leading lines in the stock market. A three-line technical indicator uses an exponential moving average (EMA) based on the average price and two more channel lines placed on either side of the EMA.

If you want to change it, you can set the distance between these channel lines and the center EMA to twice the Average True Range (ATR). Swing traders use Keltner Channels to find trends and times when stocks are high or oversold by observing when prices go beyond these channels.

5- Trend Following

Strategies that follow trends, also known as trend trading, are like GPS for the stock market. These strategies involve finding the market trend and making moves in that direction. The goal is to profit from momentum changes within the trend.

Technical indicators such as moving averages, ADX, and trendlines are often used by swing traders, who use trend-following techniques to figure out the weakness and direction of the trend. People often buy on pullbacks in an upswing or sell on rises in a downturn, hoping the trend will increase and make the trade profitable.

Don’t Miss Reading: Have you ever wondered about the mysterious dance of the market, where values rise, fall, or seem to linger in a holding pattern? If you want to understand the language of financial markets, you need to understand the concepts of market behavior, which include uptrends, downtrends, and range markets.

Best Cryptocurrencies for Swing Trading

This list shows the most popular cryptocurrencies for swing trading because of their high fluctuation and high liquidity:

Bitcoin (BTC)

- Market Leader: Bitcoin is the most well-known and valuable cryptocurrency globally.

- Level of Liquidity: Bitcoin has a high level of liquidity, which allows many people to trade.

- Volatility Potential: The price of Bitcoin changes frequently, giving swing players many chances to make money.

Ethereum (ETH)

- Second Place in the Market: ETH is the second-biggest cryptocurrency in terms of market value.

- DeFi Demand: There is a lot of interest in Ethereum’s environment for decentralized finance (DeFi) apps.

- Chances of Swing Trading: Swing traders who want to profit from market trends like ETH because it is easy to buy and sell, and its price changes a lot.

Cardano (ADA)

- New Technology: ADA works on making decentralized apps (dApps) scalable and long-lasting.

- Rising Popularity: Cardano is becoming more popular, and its strong growth team and growing image help to make this happen.

Dot (DOT) Polkadot

- Interoperability Platform: Polkadot helps different blockchains work together by connecting them.

- Decentralized Web Access: Polkadot’s technology can help swing traders interested in the decentralized web (Web3).

Binance Coin (BNB)

- Binance Ecosystem: Users pay trade fees with BNB, the exchange’s currency.

- High Volume: There are many trades and a lot of demand for BNB on the Binance market.

The Dogecoin (DOGE)

- Community-Driven Asset: DOGE became well-known as a meme coin with a strong fan base.

- High Volatility: The price of DOGE changes frequently, which attracts buyers who want to take on more risk in their deals.

Day Trading vs. Swing Trading

| Aspect | Day Trading | Swing Trading |

| Holding Period | Intraday: positions are opened and closed within the same trading day | Multiple days to weeks; positions held for medium-term price movements |

| Position Size and Margin | Often larger position sizes relative to account size; may use day trading margins (e.g., 25%) | Smaller position sizes; leverage may be used (e.g., 50%) to manage overnight risks |

| Focus | Accepts overnight risks; price gaps may affect positions due to external events. | Medium-term price movements: capture larger trends over several days or weeks |

| Market Exposure | Minimises exposure to overnight and weekend risks; closes positions before market close | Accepts overnight risks; positions may be affected by price gaps due to external events |

| Risk Management | Short-term price movements; capitalize on intraday fluctuations | Allows for a more relaxed approach with longer holding periods; focuses on technical analysis with some consideration of fundamental factors |

Swing Trading Tips for Beginners

Here are some tips that can help new buyers succeed at swing trading:

- Do Enough Research: To build a strong base of information, take the time to learn about swing trading from online tools, books, and classes.

- Start Small: Put your money into small trades at first to reduce your losses while you gain experience and trust in your trading skills.

- Use Stop-Loss Orders: Set stop-loss orders to protect your capital and limit losses if a trade goes against you. This helps prevent hasty decisions and ensures that risks are managed in a controlled way.

- Be Patient: Don’t rush into trades; wait for opportunities that fit your plan. Do not jump into trades because you fear losing out (FOMO). Instead, focus on staying disciplined.

- Create a Plan: Write down your trade goals, how much risk you are willing to take, and your method in a detailed trading plan. A clear plan will help you stay focused and follow through with your trade.

- Maintain Discipline: Adhere to your trade plan and avoid making hasty choices based on your feelings. You must be disciplined to be great at swing trading, so stick to your plan even when things get tough.

When Is the Best Time to Trade Stocks Using Swings?

Many factors, such as market conditions, personal tastes, and risk tolerance, affect the best time to use swing trading in the stock market.

Swing trading can be useful when prices change quickly or when there are clear trends. It lets traders make money from short—to medium-term price changes. The choice of time frame is very important.

Shorter time frames offer more buying chances, but you must make decisions faster. Longer time frames offer security, but you may have to hold stocks for longer amounts of time. Advising trading only works if your trade strategy fits your goals and the market conditions.

Is Swing Trading a Good Way to Make Money?

Yes, swing trading can make you money if you do it right. How much money you can make from trading depends on whether you use a stock trading plan. Generally, a plan that works should bring in more money than one that doesn’t.

The truth is that most people who want to trade don’t have a trading strategy that works, even though they think they do. Before you can be sure that what you are working on works, you need to test the plan using the past.

FAQ

Most frequent questions and answers

The main goal of swing trading is to profit from medium-term price changes by keeping contracts for days to weeks. On the other hand, day trading means making several trades in one day wto makesmall gains quickly and eendall positions by the end of the day.

To help them make decisions, swing traders use toving averages, momentum indicators, price range tools, and mood indicators. Also, they look at complex designs like cups and handles or head and shoulders forms.

Even though swing traders can trade many different securities, they usually choose large-cap stocks because they are easy to buy and sell. Swing trading can also be done in the actively traded commodities and foreign exchange markets.