The Relative Strength Index (RSI) is useful for determining if a stock is overbought or oversold. Market momentum acts something like an upwards-flung ball. When thrown, a ball will continue to travel until it reaches its highest point, at which point it will begin to fall. Measuring price movement follows similar concepts to how scientists estimate the speed and acceleration of the ball.

The Relative Strength Index (RSI) is a well-liked method for measuring momentum in the stock market. It is a popular indicator in technical analysis since it is based on momentum. The RSI indicator looks at the ratio of recent price increases to decreases at the stock’s closing price. In the following, we will elaborate on the Relative Strenght Index (RSI) and all the aspects of this useful indicator.

What is the Relative Strength Index (RSI)?

One of the most well-known and widely-utilized momentum oscillators is the Relative Strength Index (RSI). J. Welles Wilder, a renowned mechanical engineer who later became a technical analyst, was the first to create it. The RSI assesses the rate of change and the velocity of market price fluctuations.

When calculated over a standard time frame of 14 days, the RSI oscillator’s readings swing wildly between 0 and 100. If the RSI reading is below 30, the market is considered oversold; if it’s over 70, it’s considered overbought.

Swing traders use it all the time. They monitor the market for indications of a market’s short- to medium-term price momentum weakening or strengthening. Trading chances typically occur just before a reversal in a short-term trend, which might occur when the market is overbought or oversold.

Hints to keep in mind

- The Relative Strength Index (RSI) was first established in 1978 and has since become a widely used momentum oscillator.

- Underneath the price chart, technical traders commonly display the Relative Strength Index (RSI) since it gives useful information regarding bullish and bearish market momentum.

- Overbought is when the RSI for that asset is at or above 70 and oversold is when it drops below 30.

- A common trading indication is the RSI line falling below the overbought line or rising above the oversold line.

- Trading ranges, instead of moving markets, are where the RSI shines.

Why Does RSI Matter?

- Traders may use RSI to anticipate how a security’s price will move.

- It’s a useful tool for confirming trends and reversals for traders.

- It may signal whether a security is being overbought or oversold.

- It may provide buy and sell indications to short-term traders.

- It’s a technical indicator that may supplement trading plans when combined with others.

How to Calculate the RSI?

The Relative Strength Index (RSI) measures how much an asset has gained or lost over a certain period. The RSI was calculated using 14 periods since it is the setting Wilder recommended in his book. Rather than being written as negative numbers, losses take on a positive sign. Simple 14-period averages are used for the first estimates of average gain and average loss:

- Average Gain = [(previous Average Gain) x 13 + current Gain] / 14.

- Average Loss = [(previous Average Loss) x 13 + current Loss] / 14.

The past averages and the present gain loss form the basis for the second and subsequent calculations. Taking the average of the two most recent values is a smoothing method analogous to computing an exponential moving average. The longer the time period used in the computation, the more precise the resulting RSI number.

When generating RSI values, SharpCharts employs at least 250 data points before the start date of every chart (if that much data exists). A formula would require at least 250 data points to reproduce our RSI statistics.

Using Wilder’s formula, we can transform RS into a normal oscillator ranging from 0 to 100. Due to RSI’s inherent range limitations, the normalisation process makes spotting outliers much simpler.

- When Average Gain is 0, RSI also equals 0. A 14-period RSI score of 0 indicates that prices have fallen during the last 14 sessions. There were no observable improvements.

- When the Average Loss is at zero, the Relative Strength Index reads 100. This suggests that during the 14-period analysis, prices rose consistently with no measurable declines.

Tips to know for calculation RSI

Smoothing has a noticeable effect on the RSI numbers. After the first computation, RS values are smoothed. For the first method, we divide the total number of losses by 14. This gives us the average loss. Multiply the old value by 13, add the new value, and then divide the sum by 14. This has the effect of softening the edges.

Average Gain works the same way. Variations in RSI readings may occur due to smoothing during the computation period. More smoothing is possible with 250 times compared to 30 periods, which may have a little impact on RSI values. When it comes to historical data, StockCharts looks back 250 days. A “division by zero” condition happens for RS if the Average Loss equals zero, and the RSI is always 100. When Average Gain is 0, Relative Strength Index is also 0.

How to Use RSI With Trends?

To do so, you need to follow two steps:

Adjust the RSI Levels to Follow the Trends

Understanding RSI readings requires knowledge of the security’s principal trend. For instance, renowned market specialist Constance Brown, CMT, hypothesised that an oversold RSI reading during an upward trend would likely be considerably over 30. Similarly, a rating below 70.2 indicates overbuying during a downward trend.

The following chart illustrates how, during a decline, the RSI peaks closer to 50 than 70. Traders could see this as a more definitive negative signal. When a strong trend is in place, many investors draw a horizontal trendline between the levels of 30 and 70 to identify the general trend and extremes better.

Alternatively, suppose the price of a share or asset is in a long-term horizontal channel or trading range (instead of a strong upward or downward trend). In that case, adjusting overbought or oversold RSI levels is typically unwise.

When markets are trending, relative strength is less useful than in a trading range. In fact, many traders are aware that the RSI’s signals, particularly during extended bull or bear markets, are not always reliable.

Apply Trend-Fitting Buy and Sell Signals

The idea of trend-following signals and methods for trading is connected. In other words, traders can avoid the false alarms generated by the RSI in trending markets by focusing on positive indications when the price is in a bullish trend and negative signals when a stock is in a bearish trend.

What is Overbought or Oversold in RSI?

When the RSI indicator rises over 30 on the RSI chart, this is considered bullish, whereas a fall below 30 is considered bearish. Or, RSI readings of 70 or above might indicate that an investment is heading into an overvaluation or overbought zone. It might soon see a reversal in trend or a corrective price drop. When the RSI falls below 30, an oversold or undervalued situation occurs.

A stock is considered overbought when its current market price exceeds its actual value. That’s because technical and fundamental analysts agree that the current price is too high. When traders notice signs that a security is overbought, they may anticipate a price drop or reversal in trend. So they could unload the stock.

The concept is the same for an asset that technical indicators such as the relative strength index have identified as oversold. In some ways, it is trading for less than it’s worth. Investors looking for such a signal can decide to purchase the investment in anticipation of a price drop or reversal in the trend.

What is The Meaning of RSI Ranges?

The RSI values can settle into a band or range during trends. The RSI should be consistently over 30 and towards 70 during an upswing. It is unusual for the RSI to be over 70 during a decline. The indicator often falls below 30.

Following these rules may aid traders in assessing the power of a trend and identifying possible reversals. If, during an uptrend, the RSI fails to cross 70 on several successive price movements and then falls below 30, the uptrend starts to weaken and may revert downward.

So, we see the inverse if we look at a downward trend. A weakening downtrend that shows signs of a reversal to the upside fails to hit 30 or below and then has a subsequent rally over 70. Using the RSI in this manner benefits from the addition of other technical tools like trend lines and moving averages.

Never mistake RSI for relative strength. The first is a shift in the rate at which the price of a single security is rising or falling. The second evaluates the relative price changes of any securities.

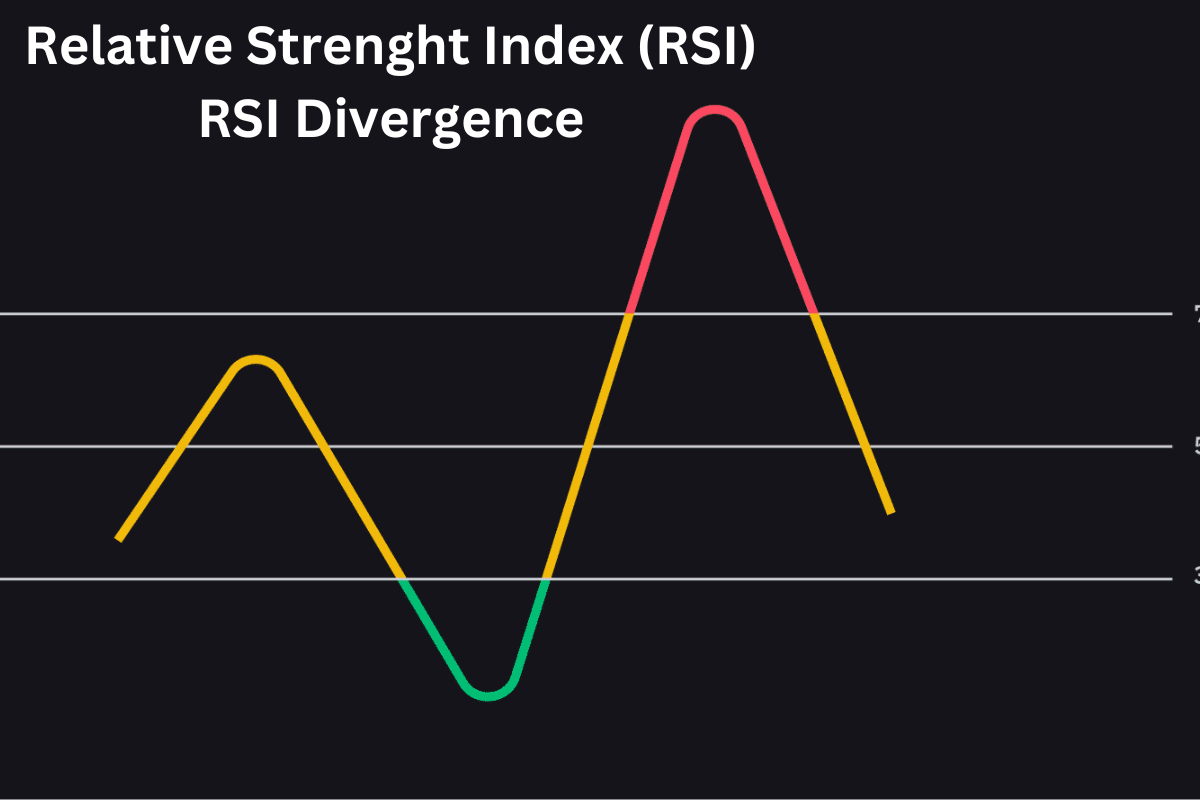

What are the Divergences in the RSI Indicator?

When the price goes in the opposite direction of the RSI, this is known as a divergence. In fact, a chart may show a shift in momentum ahead of a corresponding price shift.

- Bullish divergence: When the RSI shows an oversold reading and then a higher low comes with lower lows in price, this is considered a bullish divergence. Assuming this trend continues, a break above the oversold zone might signal the entry into a long position.

- Bearish divergence: When the RSI reaches an overbought level, and then a lower high emerges alongside greater price highs, this is known as a bearish divergence.

See how the RSI makes higher lows while the price makes lower lows in the above chart, indicating a positive divergence. However, divergences may be infrequent when a stock is in a strong long-term uptrend. Oversold and overbought levels may be adjusted to detect possible signals better.

Negative-positive RSI reversal example

Traders also keep an eye out for reversals in both the positive and negative directions of the RSI concerning the price.

- Positive RSI reversal: If the price of a security drops to a new low higher than its previous low, and the RSI drops to a new low lower than its prior low, we may see a positive RSI reversal. This pattern is a bullish one and a buying signal for traders.

- Negative RSI reversal: When the RSI achieves a greater high than its previous high, and the price of an asset reaches a lower high simultaneously, this may indicate a negative RSI reversal. A bearish pattern such as this one would be a sell indication.

RSI Swing Rejection; example and explanation

Another trading strategy is to watch how the RSI reacts when it leaves extreme overbought or oversold levels. A bullish swing rejection is a four-part signal:

- RSI readings have dropped to oversold levels.

- The relative strength index (RSI) rises over 30 once again.

- Another decline emerges in the RSI without falling into oversold levels.

- Then, the RSI surpasses its most recent high.

The next chart shows that the RSI indicator was oversold, rose over 30, and then dropped down to create the rejection low that set off the signal. This use of the RSI is quite similar to using trend lines to analyse market action.

The bearish variant of the swing rejection signal is the inverse of its bullish counterpart. There are four components to a bearish swing rejection as well:

- The relative strength index (RSI) has entered the overbought zone.

- The relative strength index drops down below 70.

- The RSI reaches a new peak without falling back into overbought levels.

- The RSI then drops below its prior low.

The above chart shows the rejection signal for a bearish swing. This signal will have the most credibility when it follows the dominant long-term trend, as with other trading methods. During downhill trends, false positives are less likely to occur in response to bearish signals.

RSI vs MACD: What Are The Differences?

Another momentum indicator that follows trends is the moving average convergence divergence (MACD), which displays the difference in value between two moving averages of a security’s price. To get the MACD, the 26-period EMA is subtracted from the 12-period EMA. The MACD line is the numerical conclusion of this process.

Above the MACD line, we print a nine-day exponential moving average (EMA) called the signal line. It may act as a signal to purchase or sell. When the MACD rises above the signal line, traders may buy; when it falls below the line, they can sell (or “short”) the stock. One of RSI’s primary functions is indicating whether a stock is overbought or oversold regarding recent price levels. It is based on the average gains and losses in price over a certain period. Values may range from 0 to 100, with the default time period being 14 periods.

Main differences in an example

While the RSI looks at the rate of price change relative to their previous highs and lows, the MACD analyses the connection between two EMAs. Together, these two indicators offer a more comprehensive technical overview of a market for analysts.

Both of these metrics evaluate the rate of change in a stock. However, since they measure multiple variables, they may provide conflicting information. For instance, if the RSI stays over 70 for a long time, it indicates that buying pressure has been excessive on a certain security.

Meanwhile, the MACD may suggest that the security’s purchasing momentum is rising. Either indicator’s divergence from price (price rising while indicator falls, or vice versa) may foreshadow a reversal in the trend.

What are the Main Limitations of RSI?

The Relative Strength Index (RSI) is an oscillator that evaluates market trends by contrasting bullish and negative price momentum. Signals from this technical indicator are most trustworthy when they follow the general long-term pattern.

Because true reversal signals are uncommon, distinguishing them from false alarms may be challenging. A bullish crossing followed by a quick drop in the stock price would be an example of a false positive. In the event of a bearish crossing followed by a sharp upswing in stock price, the indicator would have given a false negative.

Given that the indicator shows momentum, it is possible for an asset with considerable momentum in either direction to be overbought or oversold for an extended period. Therefore, the RSI is most effective in a market when prices fluctuate between bullish and bearish extremes (a trading range).

Which RSI Settings Are Most Optimal?

The RSI’s default look-back time is 14, but you may change it to be more or less sensitive. Overbought and oversold conditions are more likely to occur on a 10-day RSI than a 20-day RSI. The volatility of an asset also affects the look-back parameters. Overbought and oversold conditions are more likely to occur in the 14-day RSI of a highly volatile stock, like Amazon (AMZN) than in the case of a less volatile stock, like Duke Energy (DUK).

Modifying the conventional overbought and oversold levels to meet specific security or analytic needs is possible. If you want fewer overbought/oversold signals, try increasing the overbought threshold to 80 or reducing the oversold level to 20. When trading on a short time frame, it is common practice to apply a 2-period RSI and watch for overbought levels over 80 and oversold levels below 20.

Should I Invest When the Relative Strength Index (RSI) Is Low?

When the RSI for security drops below 30, some investors see this as a buy signal. The reason for this is the expectation of a price increase since the security has been oversold. Yet the broader setting will play a role in determining how trustworthy this signal is. Oversold levels may persist for extended periods if an asset is stuck in a prolonged downturn. Traders in such a position may await confirmation from further technical indications before purchasing.

RSI FAQs

How Does a High RSI Affect the Result?

Given that the primary function of the relative strength index is to identify overbought and oversold conditions, a high RSI value may indicate that a security is overbought, and the price may fall as a result. As a result, it may indicate that the security should be sold.

Can You Use RSI for different timeframes?

Yes, the RSI may be added to charts of any timescale (daily, weekly, hourly, and minute). Your trading plan and objectives will determine the optimal period for its use.

Is it possible to rely just on the RSI?

While the RSI is a useful tool, it is best not to rely only on it. It works best with other methods to verify signals and prevent false positives.

Is it possible to use the RSI in non-trending or sideways markets?

The RSI may still be a helpful indicator even when the market isn’t moving. It can spot probable overbought and oversold levels that might signal impending price movements even in a range-bound market.

How Do You Determine a Good RSI Level?

Traders searching for potential investments should target RSI readings of 30 or below. This paves the way for them to search for underpriced investment opportunities with the expectation of future price appreciation. However, because market circumstances may shift rapidly, investors should maintain self-control and avoid making sudden decisions.

What Does It Mean When a Stock Is Overbought?

When the market price of a stock is higher than its true worth, we say that the stock is overbought. This indicates that the stock is trading below its actual worth. Instead, it’s selling at a price that’s much over the true value.

What Does Oversold Indicate in a Stock?

An oversold stock is currently trading at a discount to its fair market value. Its current market price is much below its intrinsic value. As a result, its true value exceeds its current market price by a significant margin.