Yes, you may start trading Forex without money. Many people think that trading takes a big investment, but there are many creative ways for people who want to trade to get into the foreign exchange market without having their own Money. Among these options are taking advantage of traders’ attractive bonus programs and joining top programs that test traders’ raw potential.

Even though it might seem hard, people who want to become traders can use these chances to make Money in the Forex market and make their dreams come true. But it’s important to remember that investing always has risks, even when you don’t have any money to lose. Some of the best ways include:

Top 8 Ways to Trade Forex Without Money

Making a living as a trader on a tight budget is difficult, but it is certainly doable with the correct approach and chances. If you want to become a trader in forex without Money, you should carefully consider which method best fits your goals and trading style.

For starters, here are the five best choices to start forex without money:

1- Copy-Trading: Share Your Signals and Earn Money

Copy trading is a new way for investors to trade in the financial markets. Using special tools or software, investors can copy the trades of experienced traders called signal sources.

The first step is for buyers to choose signal providers based on their trade style, risk tolerance, and past success. After selecting, the investor may easily replicate the signal provider’s real-time transactions by linking their trading accounts.

The automation feature ensures that every deal made by the signal provider is also made in the follower’s account, including entry and exit points, position sizes, and risk management strategies.

Signal providers and followers work together to benefit both parties. On the other hand, followers can learn from more experienced traders, and signal providers can profit from their trading skills.

How do you start copy trading like a pro?

Here are the steps you need to take to become a signal source and start making money from copy trading:

- Create a Trading Strategy That Will Make You Money: You could, for instance, use moving averages and support/resistance levels to make a trend-following plan.

- Open a Trading Account: Sign up for a trading account with a trusted company that lets you copy trades. One option is to pick a broker that lets you copy other traders, like eToro or MetaTrader.

- Build a History of Successful Trades: If your approach is based on forex pairs, you can show that you can consistently make Money with EUR/USD or GBP/USD.

- Set up Your Profile: Create a thorough biography on the copy trading site that discusses your trade experience and strategy. You could showcase your past gains, losses, and risk-adjusted success measures.

- Offer Your Signal for Sale: Decide on a fair membership fee based on the value of your signs and the risk of following your strategy. For example, you could charge $50 monthly to access your messages.

- Give Constant Support: Answer questions quickly, give regular reports on your buying activity, and share your thoughts on how the market is changing.

- Check Performance and Make Changes: Tell your fans about any changes you make to your plan and explain why you made the choices you did.

- Grow Your Follower Base: You could reward people who already follow you if they get others to follow you, too, or you could work with other supply signal sources to reach more people.

Time To Read: Consider trading as a high-stakes game in which each move counts. Now, picture yourself with a well-thought-out strategy that would protect your Money while increasing your chances of making a profit. That is the fundamental core of a Money and Risk Management Plan.

2- Forex No-Deposit Bonuses: Trade Forex Without Money

Forex brokers often offer no-deposit bonuses to attract new buyers. These incentives, which usually range from $5 to $100, provide traders with a modest amount of money to get them started in the markets.

Even though these offers look good, it’s important to know that they come with terms and conditions, like trade volume requirements and payout limits. With these perks, buyers can start making trades immediately without depositing any money into their accounts. This makes Forex dealing more open to more people, especially those who might not have the money to make a big payment.

- Example: A forex exchange gives new users a $30 bonus when they sign up with no payment required. However, traders may have to make deals worth 30 times the bonus amount, or $900 in this case, to cash out any gains they made with the bonus. Also, there might be a limit, say $100, on how much earnings can be taken out. That means a trader could only take up to $100, even if they make more than $100 with the bonus.

Don’t Miss Reading: Liquidity shapes market dynamics and significantly influences trading outcomes. By exploring the concept of liquidity, its importance, and the factors that influence it, traders can gain valuable insights to navigate the forex market successfully. Liquidity trading strategy is the ease of buying or selling an asset without causing significant price fluctuations.

3- Forex Demo Contests: Enrol in Matches and Get Paid

Forex firms organize events called “contests” in which traders compete against each other using sample or real trading accounts. Participants in these events can trade forex without money; if they are successful, they can win real money.

The main goal of these competitions is to make the most money in a certain amount of time by making successful trades. Traders often receive a virtual starting payment, and the contest winner is the person who makes the most money by the end of the contest period.

Types of Forex Contests

Demo Contests: Players don’t have to worry about losing because they participate using demo accounts loaded with fake Money. Demo competitions are especially good for newbies who want to practice trading forex without Money.

- Example: A forex company holds a sample event with $10,000 in prizes. Everyone who enters gets $100,000 in fake Money to trade with. At the end of the game, the investor who made the most money wins the grand prize.

Live Competitions: Held on actual trading accounts, live competitions are different from demo contests in that real Money is involved. These challenges are for traders with extensive experience who are confident in their trading skills and ready to trade real Money.

Example: A firm holds a live trade game with a $50,000 cash prize. Participants put their money into a live trade account and compete against each other for the biggest percentage return or the lowest loss over a certain amount of time, like a month or quarter.

Pros and Cons of Participating in Forex Contests

| Benefits | Drawbacks |

| Gain practical trading experience | It may promote risky trading behavior to chase high returns |

| Test brokers and platforms | Limited prize winnings compared to potential losses in live trading |

| Apply real market analysis methods | Some contests may have strict terms and conditions |

| Start trading without investments | Trading on demo accounts may not accurately reflect real conditions |

| Compete for cash prizes | Excessive focus may distract from long-term trading goals |

| Build confidence in trading skills | This can lead to over-trading or emotional decision-making |

| Receive recognition for trading achievements | Not all brokers offer fair and transparent contest conditions |

4- Get a Trading Job: Use Your Knowledge To Work for Others

You can start a trading career without using your money by getting a job at a financial company or private trading business. Individuals in these positions usually get base pay and the chance to earn some of the gains from selling.

However, getting into this field can be tough and requires a strong academic background and exceptional trade skills.

Best Trading Jobs

Here are a few different choices:

Apply for Jobs as an Entry-Level Trader: Start-up trading jobs are available at many financial companies, such as investment banks like Goldman Sachs and JPMorgan Chase.

- Example: In the trading section of JPMorgan Chase, for example, they might be looking for Junior Traders. Their duties could include executing trades, managing risk, and analyzing the market.

Look for Trading Internships: Recognized companies like Morgan Stanley and Citigroup offer internship programs that provide valuable hands-on training in trading settings.

- Example: Morgan Stanley’s Trading Summer Analyst Program allows interns to work with experienced traders and learn about different trading goods and tactics.

Look into Proprietary Trading Firms: These companies hire top people from various backgrounds.

- Example: Jane Street and SIG (Susquehanna International Group) are examples of proprietary trading firms that trade using the firm’s own money.

Think About Opportunities for Remote Trading: Roles that allow you to trade from home or anywhere else are flexible and offer this added advantage. Reliable traders can work from home with companies like Maverick Trading and Remote Day Trader.

- Example: Maverick Trading lets users from home trade stocks, options, and other financial products.

Attend Trading Bootcamps or Workshops: The Trading Academy or the Institute of Trading and Portfolio Management, for example, offers intense training classes. These schools give you real-world knowledge and help from traders with much experience.

- Example: The Trade Academy holds risk management and trend analysis classes to help people learn important trade skills.

Suggest To Read: Understanding how the MACD indicator works and interpreting its signals is essential for traders looking to incorporate technical analysis into their trading strategies.

5- Start Trading Forex Without Money With Forex Proprietary Firms

Through a supported trading plan offered by Forex proprietary firms such as Topstep, traders can access capital without losing money. As part of the review process, traders use fake funds provided by the company to show how good they are at trading. When the course is over, traders are given money to trade on real markets with the company’s money and get a cut of their gains.

These companies take on the risk of capital and help traders in a way that fits their trading style and risk tolerance. Forex demo accounts are a cheap way for traders to get experience and maybe even make money on the market without spending much money.

How To Join Forex Proprietary Firms?

To join a Forex proprietary firm, here are the steps:

- Sign Up and Apply: Visit the company’s website and find the signup area. You will need to fill out some general information about yourself here. It’s only your name, email address, and maybe a few other information, so don’t worry.

- Going through the Evaluation Process: Once you submit your application, you must get to work. The company provides sample trade accounts, which you can use to trade as much as you want, showing off your skills and reliability.

- Follow the Rules for Funding: If you’ve shown the company how good you are at investing, you’ll move on to the next step. Traders who pass the test and meet the firm’s cash requirements will receive a treat.

- Trade Live Markets: Traders will use the company’s money, so you can experience all the thrills of real dealing without risking your money. Plus, you’ll get a cut of the money that comes in.

Trading With Pattern: Harmonic patterns in trading have become indispensable tools for traders seeking to navigate the complexities of financial markets.

6- Trade Forex Without Money With Forex Affiliate Programs

Making money with Forex partner programs means sending new traders to Forex firms and getting paid. Affiliate programs let people sign up with an exchange, get a unique reference link, and then share it to get new buyers.

The partner gets fees depending on how well these traders do after signing up and dealing. This method allows people to make passive income without trading Forex.

However, to be successful in Forex partner programs, you need to be skilled at marketing, networking, and attracting and keeping traders.

How Much Is the Price for Forex Affiliate Programs?

As an experienced affiliate partner, you will continue to earn 15% to 50% of the profits made by users you refer as long as their accounts are open. For example, you could make $300 to $1,000 if a trader you sent them makes the exchange $2,000 in profits.

Some brokers also offer CPA (Cost Per Acquisition) payouts, usually between $100 and $500 for each new user who makes their first account. There may also be a combination approach combining CPA and income share, which would be a fairer and possibly more profitable way to make money.

Marketing Your Forex Affiliate Link

| Category | Strategies |

| Creating a Website or Blog | Content CreationSEO Optimization |

| Social Media Marketing | PlatformsContent SharingGroups and Forums |

| Email Marketing | Building an Email ListRegular Updates |

| Paid Advertising | Google AdsSocial Media AdsBanner Ads |

| Networking and Forums | Join Forex CommunitiesProvide Value |

| YouTube and Video Content | Educational VideosWebinarsChannel Promotion |

7- Earn Money From Forex Without Money Through Comments and Reviews

Engaging in various online activities such as leaving comments, writing reviews, participating in forums, opinion polls, and publishing articles about Forex can lead to rewards from brokers, including bonuses on real trading accounts.

These activities allow traders to gain experience, establish themselves as market analysts, and provide opportunities for financial incentives. Brokers often value active participation in the Forex community and are willing to compensate traders for their contributions, sometimes with substantial rewards.

Types of Activities and Rewards

- Comments, Reviews, and Posts on Information Portals: Writing detailed reviews or insightful comments on Forex platforms or forums

- Interesting Comments on Forums and Opinion Polls: Active participation in forums and opinion polls

- Publication of Surveys and Articles: Writing and publishing surveys, articles, or market analyses

Learn The Market: Have you ever wondered how traders decide which assets to purchase or sell? You may learn much about market sentiment and future price movements by analyzing candlestick patterns.

8- Start Forex Without Money Using Leverage

In forex trading, using leverage can increase your trading power by allowing you to take on bigger positions in the market with less money. With a leverage ratio of 1:100, you can trade a contract worth $100,000 even if you only have $1,000 in your trading account. In other words, you can control $100 for every $1 in your account.

Example of Trading Forex Without Money Using Leverage

For example, you may have $1,000 in your trading account and wish to trade the EUR/USD pair. With a 1:100 leverage, you can handle a $100,000 investment.

Let’s say that the rate between EUR and USD is 1.2000. At this rate, you buy one standard lot, which is 100,000 units, of EUR/USD.

If you didn’t use leverage, this move would cost you $100,000. With 1:100 leverage, on the other hand, you only need $1,000 as a cushion, which is 1% of $100,000.

If the price of EUR/USD moves in your favor by one pip (0.0001), you will make $10. Each pip change is worth $10 for a normal lot.

On the other hand, you would lose $10 if the price moved against you by one pip.

Time To Read: Fair Value Gap (FVG) is a trading approach used to spot market price variations, indicated by distinct candlestick patterns and gaps in the price history on charts.

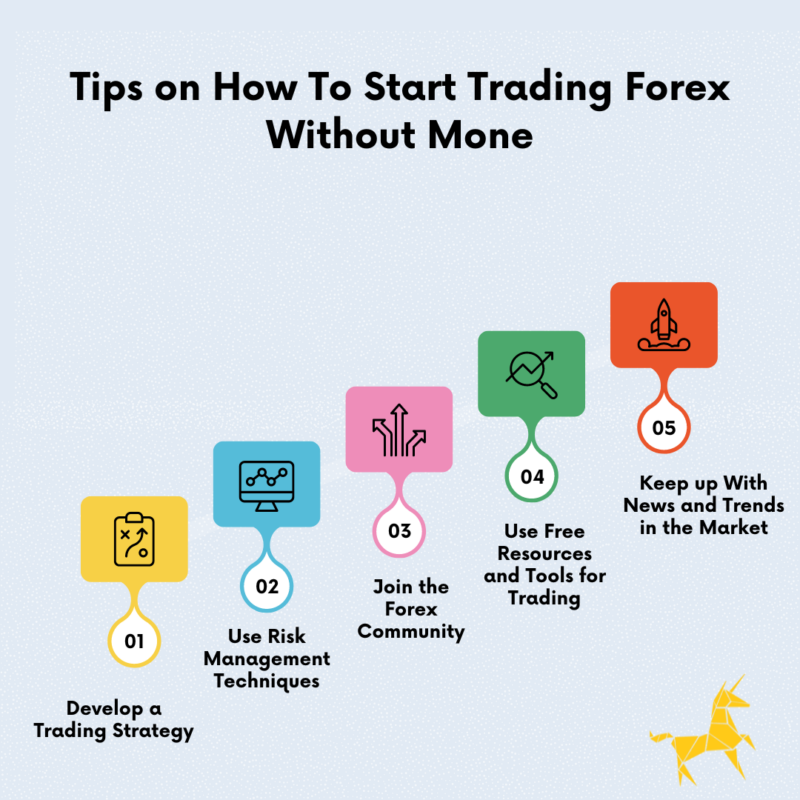

Tips on How To Start Trading Forex Without Money

Here are some tips on how to start trading Forex without money:

- Develop a Trading Strategy: Make a clear trade plan that explains how you will approach the market, including when you will enter and leave, how you will handle risk, and the terms you prefer.

- Use Risk Management Techniques: Use good risk management techniques to Protect possible gains and keep losses to a minimum. Stop-loss orders automatically let you exit trades if they go against you. Use the right position size methods to control the risk in each trade.

- Keep up With News and Trends in the Market: Read market analysis reports, use reliable financial news sources, and keep up with economic data. Knowing what affects currency exchange rates makes predictions more accurate.

- Use Free Resources and Tools for Trading: You can use economic forecasts, technical analysis tools, and training materials to improve your trade skills and make smart choices.

- Join the Forex Community: Online Forex clubs, forums, and social media groups are great places to meet other players. Participate in conversations, share your thoughts, and learn from more experienced players to improve your dealing skills and keep up with what’s going on in the market.

Conclusion

To start trading Forex without money, you can use test accounts, no-deposit offers, or social trading. With these ways, you can get experience, practice investing, and maybe even make money without putting up much money first. However, you should be very careful when using these options. You should follow risk management rules and slowly move on to live dealing with your money once you’re sure you can handle it.

FAQ

Most frequent questions and answers

Most programs don’t limit affiliates’ earnings each month or over their lifetimes until they get new approved leads.

As a computer world market, Forex does work 24 hours a day, five days a week. Therefore, traders have the greatest freedom to fit their work around other obligations as they see fit.

Most experts say that you should trade in demo accounts every day for at least three months before you trade for real money. Six months is better.

Great traders often share traits such as patience, mental discipline, intellectual curiosity, a desire to learn from mistakes, and the ability to work alone and make money.