Backtesting is an important part of trading because it lets traders accurately test how well and reliably their methods work. Traders carefully examine past market data to model trades based on specific rules for entering and leaving the market. This lets them see how their strategies would have worked in those markets.

When traders look closely at key performance measures like win rate, drawdowns, and risk-adjusted returns, they learn much about what works and what doesn’t about their tactics. This study of the past not only helps improve and perfect trade strategies but also helps people learn more about how markets work and make better decisions.

What Is Backtesting?

Backtesting is a thorough way to test how well a trade strategy or price model works by looking at how well it worked in the past using market data. Simulations of trades based on past data help traders figure out if their methods will work in the real world and decide if they are worth pursuing.

Backtesting checks how well a trade strategy or price model would have worked using past data. This lets traders see how well their methods work and make changes to improve in real trading settings. By looking at past data, traders can learn a lot about the possible profits and risks of their trading methods.

Don’t Miss Reading: Have you ever wondered about the mysterious dance of the market, where values rise, fall, or seem to linger in a holding pattern? If you want to understand the language of financial markets, you need to understand the concepts of market behaviour, which include uptrends, downtrends, and range markets.

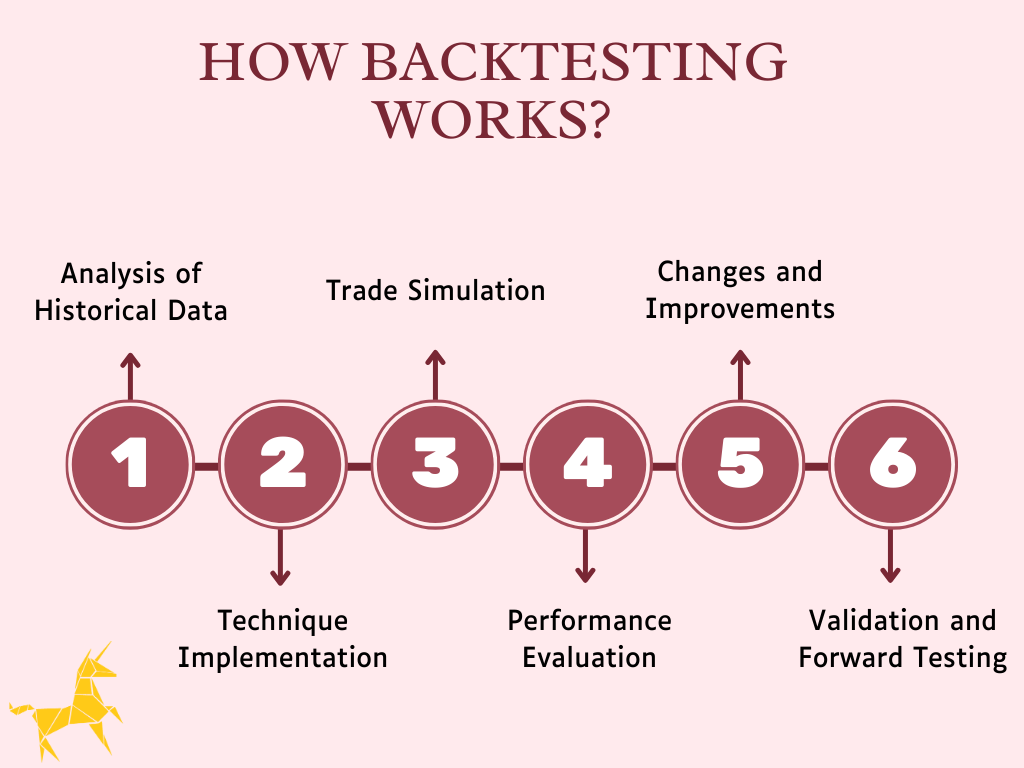

How Backtesting Works?

The process involves modelling, which deals with specific rules for when to enter and leave the market, and then examining the results to determine whether the strategy works.

Step 1: Analysis of Historical Data

The first step in backtesting is analyzing past market data, such as price, volume, and other relevant measures. Based on the goals and duration of the trading strategy, traders pick a timeline for the game, which can be anywhere from weeks to years.

Step 2: Technique Implementation

Traders set the rules and factors of their trading strategy, such as entry and exit points, stop-loss and take-profit levels, position sizes, and any other filters or conditions. You can write these rules into backtesting tools or apply them manually using past data.

Step 3: Trade Simulation

The backtesting program trades based on the strategy’s rules and data from past market events. The software keeps track of trade results, such as gains or losses, and simulates each trade based on the entry and exit criteria.

Step 4: Performance Evaluation

Traders evaluate the trading plan’s performance after the test. They determine their effectiveness by examining success measures like win rate, risk-adjusted returns, profits, and drawdowns.

Step 5: Changes and Improvements

Based on the backtesting results, traders may change their approach for better results. This could mean changing the rules for entering and leaving the market, the risk management guidelines, or the strategy settings.

Step 6: Validation and Forward Testing

After making changes, traders can test the new approach in real markets ahead of time or again using backtesting. When you do forward testing, you use data from present or future markets to see how well the new plan works in real-time.

Pros and Cons Backtesting

| Pros of Backtesting | Cons of Backtesting |

| Helps refine trading strategies quickly | Past data may not predict future market behaviour accurately |

| Enables fine-tuning of strategies for better results | Risk of overfitting models to historical data |

| Tailor strategies to individual risk preferences | Data may be skewed due to adverse events or sentiment |

| Raises the chance of successful trades | Insufficient datasets may lead to incomplete models |

| Deepens understanding of financial markets | Strategies may not perform across different market conditions |

| Risk-free testing without capital investment | Successful strategies in bullish markets may fail in bearish environments |

Pros of Backtesting:

-

- Strategy Refinement: A trader might evaluate various moving average crossing techniques over Time to find the one that consistently makes the most money.

-

- Fearless Testing: Traders don’t have to worry about losing money when they try out different factors and rules. As an example, a trader might try a new stop-loss technique in the past to see how well it works in different market situations.

-

- Historical Analysis: Buyers can learn how various assets have behaved in the past and create tactics based on those trends.

-

- Evaluation of Success: A trader might try a breakout strategy in the past and then look at the results of real breakout trades to see how profitable it is.

-

- Strategy Optimization: A trader may backtest a range-trading strategy using various entry and exit criteria to determine the best parameters for maximum profits.

-

- Mental Preparation: Backtesting helps traders prepare for real trading by modelling the ups and downs of trading emotions without losing money.

-

- Risk-free Strategy Evaluation: A backtest doesn’t take long; you can easily do a full backtest of a strategy in an afternoon to see how nicely it might work.

-

- Learning the Strategy: doing a backtest can take a few hours and include 30 to 50 trades. Faster pattern spotting and watching your trade plan’s price movement are made possible this way.

Cons of Backtesting

-

- No Guarantees: Backtesting doesn’t promise future success because past performance isn’t always a good indicator of future results. For example, a strategy that works well in backtesting might not work well in live trading because market conditions change or something unexpected happens.

-

- Data Limitations: Since backtesting uses old market data, the results may not be as accurate as possible because the data may have limitations or biases. Historical data may not correctly show market liquidity or instability.

-

- Overfitting Risk: Trading strategies can become too dependent on previous data. This happens when strategies are tweaked to fit past market conditions but don’t work well in real trading.

-

- Cost and Difficulty: Automated backtesting software can be pricey and difficult to use effectively, requiring technical know-how to set up and modify.

-

- Dependence on Market Circumstances: A plan that follows the trend might work well in markets that are moving in one direction but not so well in markets that are stuck in a certain range.

-

- Problems with Real-Time: Backtesting doesn’t consider things that happen in real-time, like loss, processing delays, or news stories that can change how well trade works.

Learn More About Forex: Money and risk management in trading involves employing strategies to safeguard capital and minimise potential losses. This is particularly crucial in dynamic financial markets where volatility can lead to rapid price changes.

Step-By-Step Guide on How to Backtest a Trading Strategy

Following these procedures, users may methodically backtest their trading techniques, discover strengths and weaknesses, and make educated choices to increase live trading performance and profitability.

Step 1: Get the Data

Before starting backtesting, you must obtain past market data for the financial items you want to trade. This information usually includes price, sales, and other important numbers for a certain period.

-

- Example: Say you want to test a moving average crossing technique for trading EUR/USD daily in the past. You get past price information for EUR/USD from January 1, 2020, to December 31, 2020. This information includes the daily starting, high, low, and ending prices.

Step 2: Define the Rules of the Strategy

Make sure you spell out your trade strategy’s rules and limits, such as the amounts of stop-loss and take-profit, as well as any other filters or conditions.

-

- Example: You use a simple moving average (SMA) crossover for the moving average crossover strategy. This means you buy when the shorter-term SMA comes above the longer-term SMA and sell when the opposite happens. These are the settings you set:

-

- Short-term SMA: 50-period

-

- Long-term SMA: 200-period

Step 3: Pick Software for Back Testing

Pick a backtesting tool or program that fits your requirements and preferences. Check for adaptability, precision, and ease of use with your trade plan.

-

- Example: You can choose MetaTrader 4 (MT4) for backtesting because it has an easy-to-use interface, strong backtesting features, and support for custom symbols and expert advisors.

Step 4: Enter Strategy Parameters

Enter the details of your trade plan into the backtesting software, including the time frame, the asset, and any other important settings. Make sure the software correctly shows your plan’s rules and goals.

-

- Example: In MT4, you create a new backtesting project for EUR/USD with a daily period and add price data from the past. Then, you can use the built-in coding language to set up the SMA crossing strategy or add a custom indicator.

Step 5: Run the Back Test

Run the backtest using past market data and plan settings. Monitor the exercise’s progress and review the trade results, including whether each trade made or lost money.

-

- Example: You launch MT4’s backtest and track the performance of the SMA crossover strategy throughout the designated period. The program simulates and executes buy and sell orders when the SMA signs cross-over.

Step 6: Evaluate How Well You Did

Look at the backtest data to see how well your trade plan worked. The Strategy’s success can be checked by looking at key performance indicators like returns, drawdowns, win rate, and risk-adjusted returns.

Step 7: Make Changes and Improve Things

Based on the backtesting results, make any necessary changes or improvements to your trading plan. This might mean changing the rules for entering and leaving the market, the risk management guidelines, or the Strategy settings.

Step 8: Make Sure the Plan Works

Test the new plan either more in the past or more in the future in real market situations to make sure it works. Watch how the plan works and make changes as needed to make it work even better.

-

- Example: To confirm the updated Strategy’s resilience in various market scenarios, you run further backtests on multiple periods and currency pairings. You can also use the technique in a demo account or “paper trading” setting for real-time feedback.

Time To Read: A liquidity trading strategy involves buying or selling an asset without causing significant price fluctuations.

How to Automate Backtesting?

When you automate backtesting, you use special trading tools to test trade methods on past market data. This method has some benefits, like being more accurate and efficient, but it usually requires some code and data entry skills.

It is common to utilise AI technology, like ChatGPT, to handle plan testing. One problem with this method is that traders must enter plans and important past data, which can take time and lead to mistakes.

Despite these problems, automatic backtesting has benefits over manual testing. It allows users to quickly try different tactics, examine large data sets, and find subtle patterns or trends that would be missed by human analysis. Several trade sites offer software that makes automatic backtesting easier.

Most Important Tips for Backtesting

Backtesting is a crucial step in evaluating the effectiveness of trading strategies before implementing them in real markets. Here are some important tips for conducting backtesting effectively:

-

- Choosing Time Frames: When you test your forex trading strategy in the past, pick dates that match the times you plan to trade. That way, the results are accurate since people can’t watch trades all the Time.

-

- Look at the Margin Requirements: Consider the balance rules, which differ for each foreign pair and exchange. It’s important to know these rules because changes in margin can affect your net gain.

-

- Testing Your Strategy: Use the backtesting program to implement your trade plan, setting entry and endpoints, risk management factors, and any other conditions you need.

-

- Running and Analyzing: Do the backtest and look at the findings, such as the profits, losses, and other success indicators. Compare the results to the goals you set for the trade and change the plan as needed.

-

- Think about Market Events: Write down any unique market events during the examined time. Include past data from important events to ensure the testing is complete.

Time To Read: Harmonic patterns in trading have become indispensable tools for traders seeking to navigate the complexities of financial markets. These patterns, rooted in the principles of technical analysis and Fibonacci ratios, offer a unique perspective on potential trend reversals.

Backtesting vs. Forward Performance Testing

Future testing, known as “paper trading,” lets you practice trading in real time without risking real money. Traders use their technique to make trades in real markets, tracking when they enter and leave trades and how well they did without actually making trades.

Backtesting and Forward Performance Testing Comparison

-

- Accuracy: Future testing can give more exact results because it studies the plan in the current market conditions, while backtesting uses data from the past.

-

- Speed: Backtesting quickly adds up the results of many trades, while future testing changes with the market in real Time.

-

- Risk: There is no financial risk in future testing because no real money is at stake. On the other hand, backtesting uses past data instead of real trades and is therefore riskier.

-

- Accuracy: Backtesting uses data from the past, which might not exactly show how the market is moving now. Future testing gives a real-time picture of how well the plan is working.

Suggest To Read: The MACD indicator is widely used in stocks, forex, and cryptocurrencies. It helps traders identify crucial market trends, including divergences, crossovers, and overbought/oversold conditions.

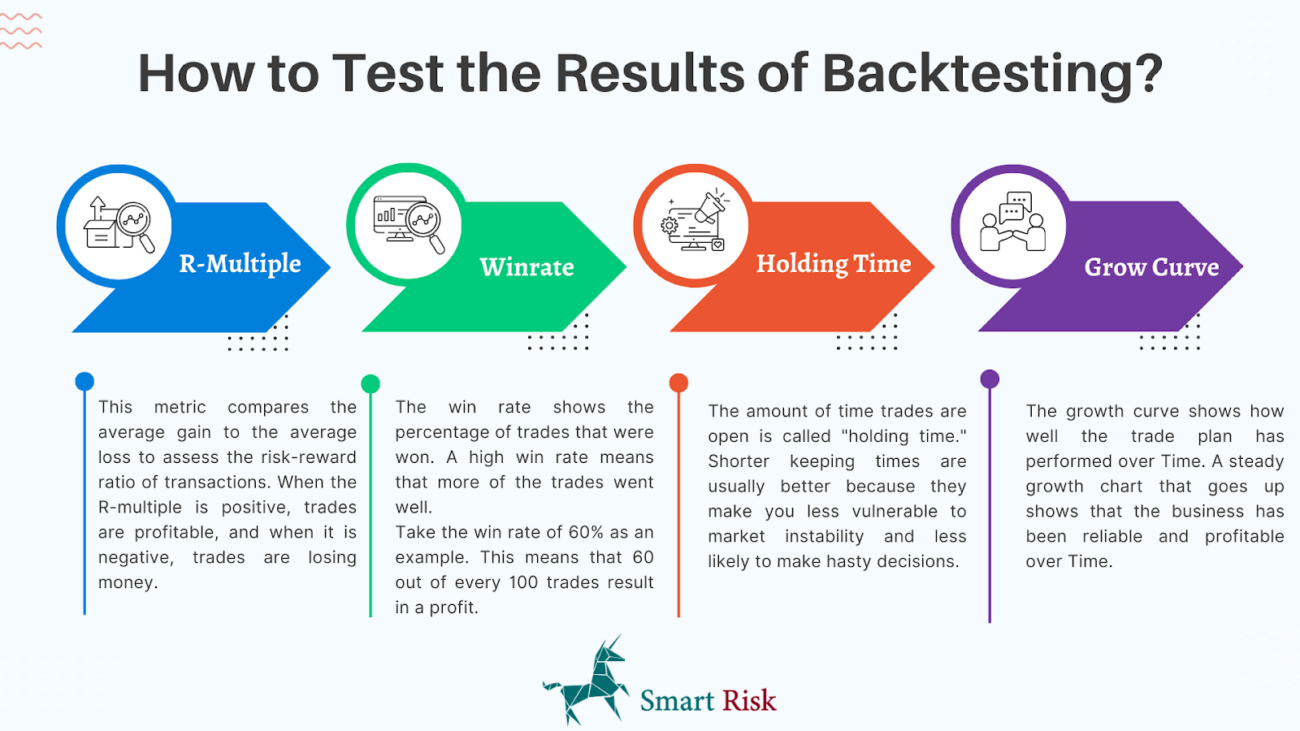

How to Test the Results of Backtesting?

When looking at the results of a backtest, it’s important to look at a few key success measures to see if a trade plan will work. Here’s a full description of each measure, along with some cases and factors to think about:

1- R-Multiple

This metric compares the average gain to the average loss to assess the risk-reward ratio of transactions. When the R-multiple is positive, trades are profitable, and when it is negative, trades are losing money.

For instance, if a trading plan has an R-Multiple of 2.5, trades that go well are 2.5 times bigger than trades that go wrong.

2- Winrate

The win rate shows the percentage of trades that were won. A high win rate means that more of the trades went well. Take the win rate of 60% as an example. This means that 60 out of every 100 trades result in a profit.

But it’s important to look at the win rate and other measures because a high win rate doesn’t mean you’ll make money if you lose more often than you win.

3- Holding Time

The amount of time trades are open is called “holding time.” Shorter keeping times are usually better because they make you less vulnerable to market instability and less likely to make hasty decisions.

For example, a swing trading strategy may hold trades for many days to weeks, but a day trading strategy may only hold trades for a few minutes to hours.

4- Grow Curve

The growth curve shows how well the trade plan has performed over Time. A steady growth chart that goes up shows that the business has been reliable and profitable over Time.

On the other hand, an unstable or unpredictable growth path may mean more risk and instability. For example, if two methods give the same returns but one has a smoother growth curve with fewer drawdowns, it might be worth considering because it has lower risk.

Suggest To Read: Fibonacci retracement levels are horizontal lines on a price chart used in technical analysis to identify potential support or resistance levels in a financial market. These levels are based on key mathematical ratios derived from the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones.

Top 5 Best Free Backtesting Software

There are several free options available for backtesting trading strategies:

-

- MetaTrader 4 and MetaTrader 5 (MT4/MT5): Both platforms offer built-in strategy testers that allow traders to backtest their strategies using historical data. Traders can access various markets, assets, and technical indicators for analysis.

-

- TradingView: TradingView provides a web-based platform with powerful charting tools and a strategy tester. Traders can backtest their strategies on various markets and timeframes using historical data.

-

- Python with Pandas and Backtrader: For traders with programming skills, Python combined with libraries like Pandas and Backtrader offers a flexible and customisable solution for backtesting strategies.

-

- QuantConnect: QuantConnect is a free, cloud-based platform that enables traders to develop, backtest, and deploy algorithmic trading strategies using C# and Python. It provides access to historical data and supports multiple asset classes.

-

- Zipline: Zipline is an open-source backtesting library written in Python. It allows traders to test their strategies using historical data and supports event-driven backtesting.

What Are the Best Backtest Indicators?

Backtest indicators are specific signals or levels that trigger entry or exit points in a trading strategy during backtesting. These indicators are often based on technical analysis and provide clear criteria for executing trades. Here are some examples of common backtest indicators:

-

- Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements. Traders may use RSI levels, such as crossing above or below certain thresholds like 70 or 30, to signal entry or exit points.

-

- Donchian Channels: A volatility indicator plots the highest and lowest lows over a specified period. Traders may initiate trades by triggering breakouts above or below the Donchian Channels.

-

- Ichimoku Cloud: This is a complete sign that tells you about levels of support and resistance, the direction of the trend, and velocity. To join or leave a deal, traders may look for signs like the Tenkan and Kijun lines crossing over or the price breaking above or below the Cloud.

-

- Heikin Ashi: This type of candlestick chart helps you see trends by reducing price jumps. When traders need to make a buying decision, they can use Heikin Ashi candlestick patterns or crosses.

What Is the Best Backtest Strategy for Backtesing?

Finding the best backtest Strategy is like searching for the perfect pair of shoes – it varies for each person based on factors like style, fit, and comfort. Let’s dive into a couple of methods you can consider, starting with intraday backtesting:

Strategy 1: Intraday Backtesting

Imagine you’re intrigued by the fast-paced world of day trading. Intraday backtesting involves scrutinising short-term price movements, typically on one-minute or five-minute charts.

-

- Example: Let’s say you’re backtesting a breakout strategy on a one-minute chart for a stock. Over the past week, you identified 30 breakout trades, with 20 resulting in profits and 10 losses. After crunching the numbers, your Strategy produced a net profit of $500 for the week.

Strategy 2: Swing Trading Backtesting

Now, let’s shift gears to swing trading, a strategy favoured by those with a more patient approach. Swing traders aim to capture medium-term price movements within larger trends, often holding positions for several days to weeks. For backtesting, you’d analyse daily or weekly charts, looking for patterns or indicators to signal entry and exit points.

-

- Example: Suppose you’re testing a moving average crossover strategy on a daily chart for a currency pair. You’d buy when the shorter-term moving average exceeds the longer-term average and sell when the opposite occurs. After reviewing historical data, you find that your Strategy resulted in 15 profitable trades out of 20 over the past month, yielding a total profit of 500 pips.

Is Backtesting Worth the Effort?

While backtesting can provide valuable insights into a trading strategy’s potential performance, it’s essential to approach it cautiously. Over-optimization and complexity can lead to skewed results that may not accurately reflect real-market conditions.

However, backtesting remains integral to developing a successful trading strategy despite these challenges. It offers a risk-free environment to test and refine your approach before committing to real capital. By utilising demo accounts and risk management tools, traders can mitigate the inherent risks of live trading and increase their chances of success.

FAQ

Most frequent questions and answers

Backtesting helps traders assess the viability of their trading strategies, identify potential flaws, and refine their approaches before risking real capital in live markets.

You’ll need access to historical market data and a trading platform or software with backtesting capabilities to backtest a trading strategy. Define your Strategy’s rules, input them into the platform, and run simulations using historical data to evaluate performance.

Common pitfalls include overfitting, overlooking losses, relying on outliers, and not accounting for trading conditions like Time of day.

No, backtesting cannot guarantee trading success. While it provides valuable insights, real-market conditions may differ from historical data, and other factors like emotions and market dynamics come into play during live trading.