Within the crypto world, “passive income” means making money from crypto-related actions with little to no ongoing work. This can include staking, where you hold and verify transactions to get benefits; loans, where you give cryptocurrency to people and get interest; or mining, where you verify transactions to get new coins.

These methods can provide steady income depending on how much people want to buy cryptocurrencies and how busy the network is.

It’s important to study and pick methods that fit your business goals and risk tolerance and keep up with market trends to make passive income in crypto. Some of these methods include:

- Staking

- Lending

- Mining

- Decentralized Finance (DeFi) Yield Farming

- Dividends and Revenue Sharing

- Airdrops and Rewards Programs

- Cryptocurrency Savings Accounts

- Copy Trading (Social Trading)

- Participating in Liquidity Pools

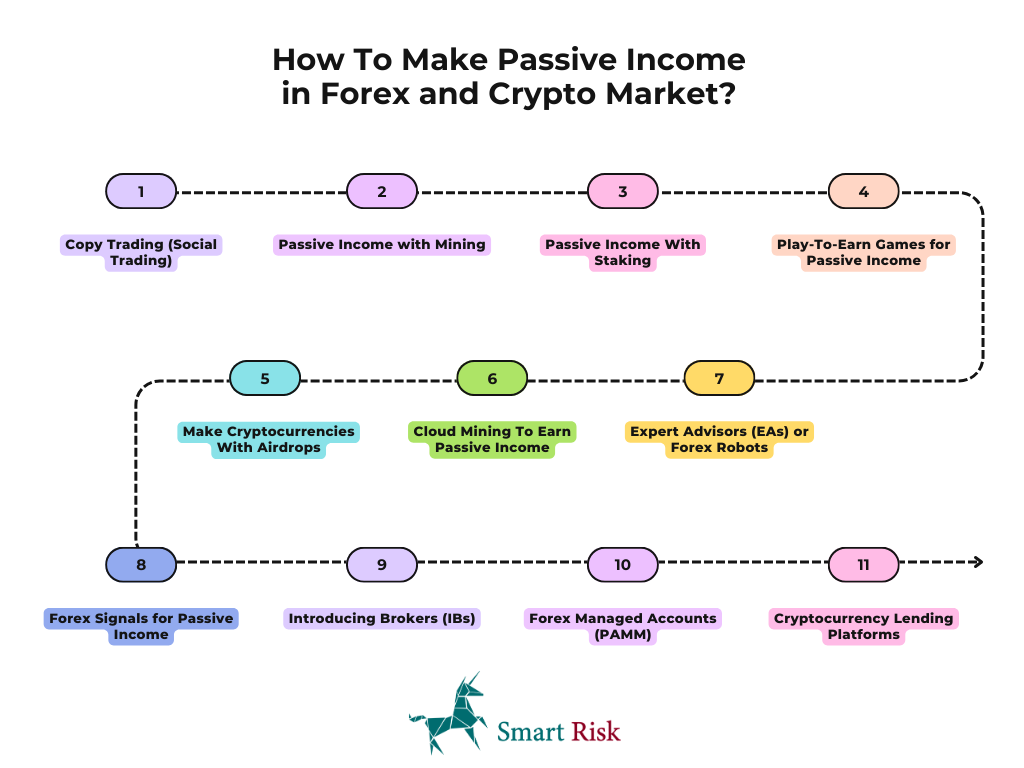

How To Make Passive Income in Forex and Crypto Market?

Here are the many cryptocurrency passive income options available, such as DeFi yield farming, lending, staking, and mining.

Methode 1: Copy Trading (Social Trading)

Copy trading, also called “social trading,” lets traders share their trading signs and methods with other investors, who then automatically make the same deals they did. If you’re a good seller, you can make money by letting others copy your moves.

| Pros | Cons |

| Profits earned from copied trades provide passive income. | Losses may occur if copied trades are unsuccessful. |

| Increased exposure and recognition among investors. | Pressure to maintain consistent performance to retain followers. |

| Earn fees from referrals through buyers’ recommendation links. | Dependence on the reputation and popularity of the trading platform. |

| Opportunity to share trade information and skills. | Limited control for followers over the actions and decisions of copied trades. |

Methode 2: Passive Income with Mining

Mining uses computers to solve hard math problems that confirm transactions and add them to a blockchain. Cryptocurrencies that use proof-of-work (PoW), like Bitcoin and Litecoin, mostly use this method.

People who mine cryptocurrency fight to be the first to find the answer to a block. The winner gets cryptocurrency as a prize. Some of the benefits of mining are that it can be profitable and help keep networks safe. Mining does, however, need special equipment, use a lot of power, and become less valuable over time as block awards drop and competition rise.

| Pros | Cons |

| Miners play a crucial role in maintaining blockchain network security. | Mining requires specialized gear (like ASICs or GPUs) and consumes much power. |

| Successfully mining a block can yield profitable cryptocurrency rewards with regular and efficient mining practices. | Mining becomes increasingly challenging over time as more miners join the network. |

| Miners often influence the governance of the blockchain network they support. | Proof-of-work mining is energy-intensive, raising environmental concerns. |

| Technical knowledge is necessary for setting up and maintaining mining equipment. | |

| Mining pools can concentrate power among a few participants. | |

| Mining entails tight control over the network, potentially leading to centralization. |

3 The Best Coins for Mining

Here are the three most important coins and projects related to Bitcoin mining:

Bitcoin (BTC): Proof-of-work (PoW) was the first mining algorithm. Bitcoin miners compete to solve the hardest cryptographic puzzles first, and the winner gets brand-new bitcoins. Mining was profitable in the past, but now there is more competition, and it’s harder to mine, which makes it less profitable.

Litecoin (LTC): Many people call Litecoin “silver” instead of Bitcoin’s “gold,” and it also uses Proof of Work mining. Making money depends on how hard it is to mine, how much power costs, and how well the equipment works. Risks include technology becoming outdated and changes in the rules.

Monero (XMR): This cryptocurrency promotes privacy and allows CPU/GPU mining. It uses the CryptoNight mining algorithm to challenge the supremacy of ASIC mining. Miners protect the Monero network and get paid with newly made coins.

Time To Read: A liquidity trading strategy involves buying or selling an asset without causing significant price fluctuations.

Methode 3: Passive Income With Staking

By locking up a certain amount of coin, staking lets you participate in the blockchain’s decision-making and validation process. Staking is appealing because it’s easier to start than mining, uses less energy, and could lead to passive income. It is used in blockchains that use proof-of-stake (PoS).

| Pros | Cons |

| Staking typically requires less specialized gear compared to mining. | Validators in some proof-of-stake systems risk losing staked coins for malicious actions or incorrect transaction confirmations. |

| Proof-of-stake consensus methods are more energy-efficient than proof-of-work ones. | Staked coins are often locked up for a specified duration, limiting liquidity. |

| Holders who stake their coins earn various benefits. | Cryptocurrency price fluctuations can impact the value of staked assets. |

| Stakers contribute to network security by validating transactions. | Staking rewards are contingent on the health and activity of the network. |

| Some staking methods can be executed directly through platforms or software wallets. |

3 Best Coins and Projects for Staking

Here are three of the best coins and projects that allow you to stake:

- Ethereum (ETH): With Ethereum 2.0, Ethereum switched to Proof-of-Stake (PoS), allowing users with at least 32 ETH to participate in staking chances. By participating in the network consensus, stakes may get incentives, which adds to Ethereum’s scalability and decentralization.

- Cardano (ADA): The Proof-of-share (PoS) consensus model for Cardano lets ADA users share by either giving their coins to a stake pool or running their pool. ADA users can easily interact with the Cardano community and help the network run with delegated staking.

- Polkadot (DOT): Staking tokens on Polkadot (a multi-chain platform) involves either nominating validators or assuming the role of validator themself. Participants who stake DOT can earn benefits and help rule and reach a decision on the network.

Methode 4: Play-To-Earn Games for Passive Income

People can earn coins by playing play-to-earn games online. Axie Infinity and Decentraland are two games that have become more popular because they offer different ways to make money. This is especially true in places with a bad economy.

| Pros | Cons |

| Play-to-earn games provide an alternative income stream. | Playing games may require significant time investment for substantial rewards. |

| The play-to-earn gaming industry is rapidly growing and has considerable potential. | Game token prices can be volatile due to market fluctuations. |

| Some games may have limited appeal or require specific skills. | |

| The play-to-earn gaming sector is relatively new and evolving. |

Methode 5: Make Cryptocurrencies With Airdrops

Airdrops are a common way to earn cryptocurrencies by advertising for crypto projects or companies. Users can get free tokens or coins by doing certain things set by the project, like joining a group, finishing jobs, or keeping certain tokens.

Airdrops are a common way for new projects to gain fans and give out coins. They can be fun and profitable, but there are risks that the project might not be trustworthy and that the value of the tokens may change.

| Pros | Cons |

| Opportunity to receive free coins or cryptocurrencies from new projects. | Participation requires minimal effort beyond meeting specified criteria. |

| Chance to discover and engage in early-stage crypto projects. | Potential risk associated with participating in projects with poor reputations or scams. |

| Diversification of cryptocurrency assets with minimal or no financial investment. | Token values may fluctuate due to market changes and trading issues. |

| Limited control over airdrop eligibility criteria and token distribution. | |

| Airdrop participation may involve privacy concerns and information sharing. |

Methode 6: Cloud Mining To Earn Passive Income

People can mine coins with cloud mining, which means they don’t have to own or manage real mining tools. Cryptocurrency miners can buy contracts from cloud mining companies to use their computers to mine coins from afar. When you use a cloud mining service, you usually have to pay for the tools they offer upfront.

| Pros | Cons |

| Ability to mine coins without the need to set up and maintain hardware. | Dependence on cloud mining service providers. |

| Offers user-friendly and scalable mining options for both novice and experienced miners. | Mining fees and market fluctuations may impact profitability. |

| No technical expertise is required for mining operations. | Potential risk of encountering fraudulent or unreliable cloud mining platforms. |

| Limited control over mining activities and hardware management. |

Methode 7: Expert Advisors (EAs) or Forex Robots

Expert Advisors (EAs) or Forex robots make investing easier by creating trades based on established rules and factors. Trading is easier with this method because it requires less work from you. A trader decides when to enter and leave a trade and the amount of risk they are willing to take.

| Pros | Cons |

| Reduced need for constant monitoring due to automation. | The development and maintenance of effective algorithms require expert knowledge. |

| Emotion-free trading decisions lead to more rational choices. | Performance may be affected by changing market conditions. |

| Ability to execute precise actions based on predefined rules. | Over-optimization based on historical data may not translate well to future performance. |

| Access to global market opportunities 24/7. | Limited flexibility to respond to unforeseen market events. |

Methode 8: Forex Signals for Passive Income

Forex signals are trading suggestions for when to buy or sell certain currency pairs. Experienced traders or computer programs usually make them. Many places, such as trade sites, groups, and social media, offer signals for free or with paid membership.

| Pros | Cons |

| Access to buying advice from knowledgeable traders. | There are varying reliability of signals; not all can be trusted. |

| Faster market study and analysis. | Dependency on external advice for trading decisions. |

| Potential for passive income by following successful signals. | Additional fees are associated with premium signal packages. |

| Trader success hinges on adherence to plans and risk management. |

Methode 9: Introducing Brokers (IBs)

Those who introduce customers to forex brokers are known as Introducing Brokers (IBs), and they get commissions for doing so. IBs get new clients and keep the ones they already have. They get paid refunds and fees based on how much trade their new customers do.

| Pros | Cons |

| No direct involvement in trading activities is required. | Income may fluctuate based on market conditions and client trading volume. |

| Access to marketing tools and support from brokerage firms. | Requires proficiency in client acquisition and relationship management. |

| Opportunity to leverage existing trading communities to expand the network. | Active trading provides more control over income generation. |

Suggest To Read: The MACD indicator is widely used in stocks, forex, and cryptocurrencies. It helps traders identify crucial market trends, including divergences, crossovers, and overbought/oversold conditions.

Methode 10: Forex Managed Accounts (PAMM)

People can put their money into Forex-managed accounts, also known as PAMM, which lets experienced traders handle a group of clients’ money. When a seller makes money, the investor’s account shows the same amount of money coming in and going out. A PAMM account involves buyers, money managers (traders), and brokers.

| Pros | Cons |

| Access to knowledge and strategies of experienced traders. | Potential losses depend on selling performance and market conditions. |

| Opportunity for passive income by delegating trading tasks. | Lack of clarity regarding trade strategies and decisions. |

| Diversification through multiple traders and investment tactics. | Management fees that reduce overall profits. |

| Investors can remain uninvolved in day-to-day trading activities. | Limited control over individual trade decisions and timing. |

Methode 11: Cryptocurrency Lending Platforms

Crypto lending sites let people earn interest on their cryptocurrency by lending it to others. To participate, you must make an account on the loan site and deposit your cryptocurrencies.

The site pairs lenders with borrowers based on the loan terms, security, and interest rates. Lenders take less risk when borrowers put up collateral to protect their loans. Also, interest rates change based on the market’s performance.

| Pros | Cons |

| Participation in lending can diversify financial strategies. | Platform risks such as security vulnerabilities or bankruptcy. |

| Borrowers provide collateral as security for loan repayment. | Risk of capital loss if borrowers default on loans. |

| Flexibility in adjusting loan terms and interest rates. | Interest rates fluctuate based on market supply and demand. |

| Limited governmental oversight in certain jurisdictions. |

Don’t Miss Reading: Fair Value Gap (FVG) is a trading approach used to spot price variations in the market, which are indicated by distinct candlestick patterns and gaps in the price history on charts.

Methode 12: The Compound (COMP)

Users can use Compound, an Ethereum-based private loan tool, to give or borrow coins. Lenders get interest based on rates set by computers. There is a chance of losing money if a user doesn’t repay the loan or if the market goes down and up.

- Aave (AAVE): Aave is a DeFi website that lets people lend and borrow different cryptocurrencies. When lenders put assets into cash pools, they make interest. The interest rates at Ave change based on supply and demand, and risks include losing money because a user doesn’t repay the loan and the platform being vulnerable.

- MakerDAO (MKR): MakerDAO is a DAO-based loan tool where users can lock cryptocurrency security to make stablecoins (DAI). People who own DAI can make interest by using stablecoins, and the platform controls interest rates.

Methode 13: Participating in Liquidity Pools

Participating in a liquidity pool means adding cryptocurrencies to decentralized finance (DeFi) systems. This provides liquidity for trades to go smoothly. By putting your cryptocurrency into a liquidity pool, you can earn fees and other rewards based on trading action. Liquidity pools help with loans, borrowing, and decentralized swaps, among other DeFi tasks.

| Pros | Cons |

| Earn trading fees and rewards as a liquidity provider. | Risk of short-term losses due to rapid changes in asset prices. |

| Access to various DeFi projects and new crypto assets. | Smart contract vulnerabilities and platform security concerns. |

| Potential for high gains compared to other investments. | Platform-specific threats such as governance issues or protocol changes. |

| Flexibility to withdraw assets from liquidity pools at any time. | Limited control over liquidity pool management and governance decisions. |

Top Bets Coins and Projects for Participating in Liquidity Pools

These are the three best coins and projects that are linked to liquidity pools:

Uniswap (UNI):

- The leading DEX on the Ethereum blockchain

- Allows coin changes using the AMM model and liquidity pools.

- People put crypto into pools and get fees and UNI tokens in return.

- Part of the trade fees go to liquidity companies.

PancakeSwap (CAKE):

- DEX and farming yields on the Binance Smart Chain.

- BNB and other assets are staked in pools by users.

- Get CAKE tokens as a prize.

SushiSwap (SUSHI):

- An Ethereum DEX system

- It works like Uniswap but with cash pools.

- Users can get SUSHI tokens by lending money.

- People who own SUSHI can take part in running the site.

Learn More: Have you ever wondered how traders decide which assets to purchase or sell? You can learn much about market sentiment and future price movements by analyzing candlestick patterns.

Methode 14: Passive Income With Yield Farming

Regarding cryptocurrencies, yield farming is all about maximizing the use of decentralized apps (dApps) to increase earnings. For instance, you can get teeth tokens in return when you stake ETH with a system like Lido.

This keeps your ETH liquid while you earn staking benefits. You can get even better returns by adding stETH to a decentralized automatic market maker like Curve Finance. This will provide liquidity and let you earn extra money and CRV tokens.

Thanks to the ability of DeFi platforms to work together, yield farming is possible, which lets buyers earn high returns by compounding interest.

| Pros | Cons |

| Harnesses the power of DeFi systems for optimized results. | Temporary loss of funds when providing liquidity. |

| Diversifies income sources through holding, lending, and earning governance tokens. | Smart contract vulnerabilities and platform-specific risks. |

| Provides accessibility to investors with varying risk tolerances. | Complexity in navigating and understanding different DeFi systems. |

| Potential impact from market fluctuations and regulatory changes. | Dependency on market conditions and policy changes. |

Methode 15: Passive Income with NFTs

Non-fungible tokens (NFTs) can earn passive income through new methods that let users make money from their digital assets. For example, sites like reNFT allow buyers to rent out NFTs for some time.

Some examples of NFT rents are for games, attending events, and owning virtual land. Holders of NFTs can make money in ways other than standard ownership by using NFT rental methods like reNFT, NFTX, or Binance NFT PowerStation.

| Pros | Cons |

| Generates income through NFT rentals. | Limited adoption and understanding of NFT rental models. |

| Earns revenue without selling or relinquishing rights. | Potential loss or depreciation in NFT value during rental periods. |

| Expands utility of NFTs beyond collectibles. | Challenges in finding suitable rental demand for specific NFTs. |

| Access to emerging platforms and methods in the decentralized market. | Regulatory uncertainties and evolving market dynamics. |

Bottom Line

Crypto can help you spread your assets and earnings to make passive income. Cryptocurrency may interest you because it has high rates that are much higher than what you can get from a bank. If you buy crypto at the right time and its value increases, you get interest on your investment and investment gains simultaneously.

FAQ

Most frequent questions and answers

If the price, volume, total value locked, or several other things change, you will likely lose money. As long as cryptocurrency is an option, investing only what you can afford to lose is best if you want to make passive income with it.

You could make $100 a day, but there’s no way to be sure of it or a certain method you can use. Trading, loan, holding, and dealing in cryptocurrency carry big risks because it is a risky and hard-to-predict asset.

It is possible to make money by running crypto nodes and ensuring safe transfers. The exact path depends on the ticket and the network. Most of the time, though, crypto nodes let you make idle income.

Numerous cryptocurrencies offer different ways to make money without doing anything. This is what the whole DeFi sector is about, and you can find DeFi on any blockchain with smart contracts. Ethereum is most likely the best example, but other networks that work similarly are also good.